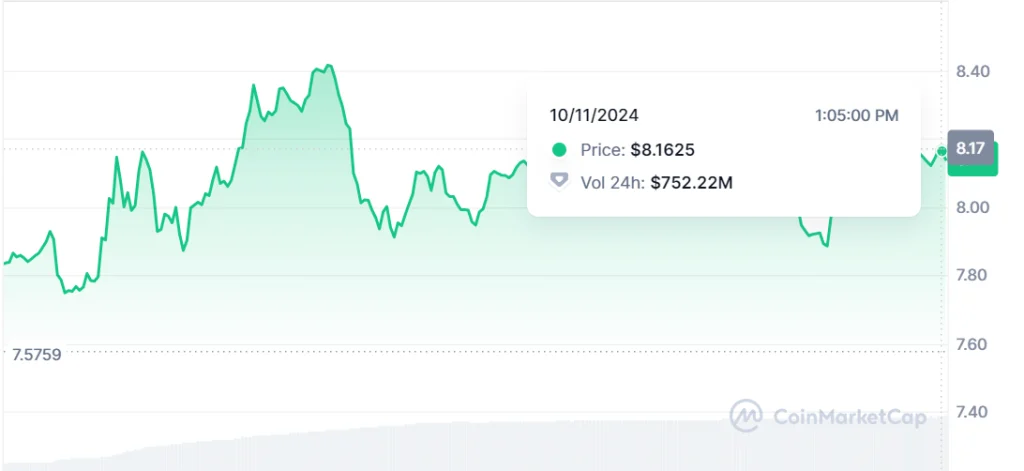

The UNI token surged by 19.21%, reaching a three-month high following the launch of Uniswap’s Layer-2 network, Unichain. Unichain is designed to improve Ethereum’s transaction speeds and reduce fees. UNI, the governance token of the Uniswap decentralized exchange, outperformed the global crypto market with significant gains on October 11. According to CoinMarketCap, UNI rose by 19.21% in the last 37 hours, climbing from $7.08 to $8.44, a price not seen since mid-July. This marks a 28% increase over the past week and a 23% rise in the last 30 days.

As of the time of writing, UNI traded at $8.16, having slightly retraced but still up around 6% in the past 24 hours. Daily trading volume spiked by more than 288%, reaching $736 million. UNI now holds the 21st position on CoinMarketCap, with a market cap of $4.88 billion, reflecting strong investor interest.

Can Unichain Tackle DeFi’s Scalability and Fee Issues?

Uniswap Labs officially launched Unichain, a Layer-2 blockchain aimed at enhancing Ethereum’s ecosystem. Built on Optimism’s Superchain, Unichain focuses on providing faster and cheaper transactions, addressing key challenges in decentralized finance (DeFi) such as scalability, slow transaction speeds, and high fees.

Unichain also seeks to resolve liquidity fragmentation, where tokens are spread across various Layer-2 networks that lack smooth interaction. By utilizing Optimism’s infrastructure, Unichain aims to create a more integrated DeFi landscape. It promises to improve transaction speeds and reduce gas fees compared to Ethereum’s mainnet, making DeFi more accessible. A private test network for Unichain is expected to launch soon, marking a significant step forward for Uniswap and its community.