Trump’s Massive Tax and Spending Bill Advances in Senate Amid Partisan Tensions

The Republican-led U.S. Senate narrowly voted on Saturday to move forward with President Donald Trump’s sweeping tax-cut and spending bill, following a dramatic weekend session marked by fierce partisan divides, procedural standoffs, and extended delays as Democrats sought to stall the bill’s progress.

Senators voted 51-49 to begin debate on the 940-page legislative package, with two Republicans—Thom Tillis and Rand Paul—joining Democrats in opposition. The bill funds many of Trump’s top policy priorities, including immigration, tax cuts, defense spending, and border security.

Celebrating the outcome, Trump posted on social media, calling it a “great victory” for his “great, big, beautiful bill.”

The vote followed hours of uncertainty, as GOP leaders and Vice President JD Vance held closed-door talks to rally hesitant senators. Democrats, meanwhile, demanded that the bill be read in full on the Senate floor—potentially delaying formal debate until Sunday afternoon.

Democratic leaders sharply criticized the proposal. Senate Majority Leader Chuck Schumer accused Republicans of trying to rush through a “radical bill” under cover of night and vowed to force a full reading before amendments could be considered. Democrats argue the bill’s tax cuts disproportionately benefit the wealthy while slashing key social programs.

Once debate begins, senators are allowed up to 20 hours for discussion, followed by a “vote-a-rama” on amendments before a final vote. Lawmakers hope to conclude the process by Monday.

Republican Defections and Intra-Party Tensions

Senators Tillis and Paul were the only Republicans to vote against advancing the bill. Tillis, who is up for reelection next year, opposed proposed Medicaid cuts that he warned would harm North Carolina, while Paul objected to the bill’s plan to raise the federal debt ceiling by $5 trillion.

Trump lashed out at both lawmakers online, mocking Paul and warning he may back primary challengers to Tillis: “Numerous people have come forward wanting to run in the Primary against ‘Senator Thom’ Tillis. I will be meeting with them over the coming weeks.”

Despite early resistance, several conservative senators—Rick Scott, Mike Lee, Cynthia Lummis, and Ron Johnson—ultimately supported the bill, though it’s unclear what concessions, if any, were made to secure their votes.

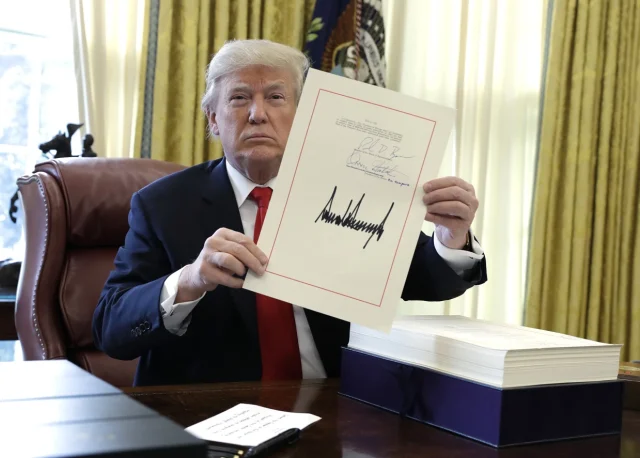

According to a senior White House official, Trump monitored the vote from the Oval Office late into the night.

What’s in the Bill?

The package extends Trump’s signature 2017 tax cuts, introduces new tax reductions, and ramps up funding for the military and border security. The nonpartisan Joint Tax Committee estimates the bill’s tax provisions would cut federal revenue by $4.5 trillion over the next decade, adding to the $36.2 trillion national debt.

Despite this, the White House claims the bill would reduce the annual budget deficit by $1.4 trillion, citing unspecified offsets and long-term growth effects.

Billionaire Elon Musk, CEO of Tesla, also blasted the legislation, which eliminates tax incentives for electric vehicles. Posting on his platform X, Musk called the bill “utterly insane and destructive” and warned it could result in massive job losses and national harm.

Key Medicaid, Tax Provisions

To ease Republican concerns from rural states, the bill would delay planned Medicaid reimbursement cuts and allocate $25 billion for rural providers between 2028 and 2032.

The legislation also raises the cap on state and local tax (SALT) deductions to $40,000, adjusted for inflation through 2029, before reverting to the current $10,000 cap. The cap would also begin phasing down for households earning over $500,000—a point of contention for House Republicans in high-tax states like New York, New Jersey, and California.

Legislative Path Forward

Republicans are using budget reconciliation to bypass the Senate’s usual 60-vote threshold, allowing them to advance the bill with a simple majority.

Democrats are expected to propose amendments aimed at reversing Republican cuts to Medicare, Medicaid, and food aid programs, arguing that the bill undermines support for the elderly, low-income families, and people with disabilities.

The legislation would also raise the debt ceiling by trillions to prevent a possible default in the coming months.

If the Senate passes the bill, it will head back to the House of Representatives for final approval before reaching Trump’s desk. The House passed its version of the bill last month.