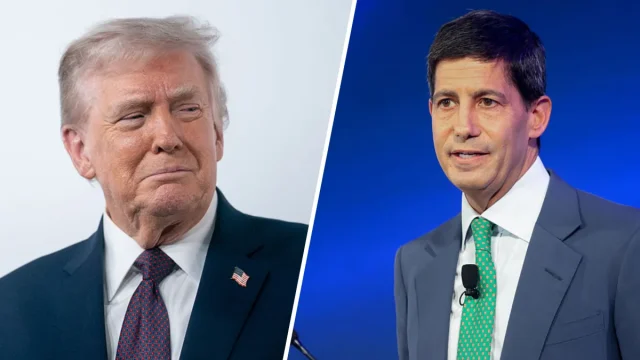

U.S. President Donald Trump said on Friday that he has nominated Kevin Warsh to become the next chair of the Federal Reserve, replacing Jerome Powell when his term expires in May 2026.

Announcing the decision on Truth Social, Trump praised Warsh as a reliable and high-caliber choice, saying he has known him for many years and believes he could rank among the greatest Federal Reserve chairs in history.

If confirmed by the Senate, Warsh would return to the central bank after previously serving as a Federal Reserve governor from 2006 to 2011. At the age of 35, he was the youngest person ever appointed to the Fed’s Board of Governors.

Following the announcement, Jaret Seiberg of TD Cowen said the nomination is broadly positive from a policy perspective, noting that Warsh brings deep knowledge of the regulatory framework. He added that Warsh’s relatively hawkish monetary background could help ease long-term interest rates, a development that would be supportive for the housing market.

Warsh currently serves as the Shepard Family Distinguished Visiting Fellow in Economics at the Hoover Institution and lectures at the Stanford Graduate School of Business. He is also a partner at Duquesne Family Office, working alongside renowned investor Stanley Druckenmiller.

During his earlier tenure at the Federal Reserve, Warsh played a central role during the 2008 financial crisis, acting as a key intermediary between the Fed and Wall Street. He also represented the central bank at G20 meetings and served as its liaison to both emerging and advanced economies across Asia.

Before joining the Fed, Warsh held senior roles in the White House, serving as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council from 2002 to 2006. Earlier in his career, he worked in mergers and acquisitions at Morgan Stanley in New York.

Powell’s current term as Federal Reserve chair is scheduled to end on May 15, 2026.

Commenting on the nomination, Chris Zaccarelli, chief investment officer at Northlight Asset Management, said confidence remains the cornerstone of financial markets. He added that Warsh’s most important task will be to preserve, and potentially strengthen, investor confidence in the Federal Reserve as an institution.

While markets initially viewed Warsh’s nomination as more supportive of Fed independence than other rumored candidates, some analysts remain cautious. Thierry Wizman, global FX and rates strategist at Macquarie Group, noted that Warsh resigned from the Fed in 2011 before completing his term due to policy disagreements. Wizman also highlighted Warsh’s past calls to revisit the 1951 Fed–Treasury Accord to allow closer coordination between monetary policy and government debt issuance.

According to Wizman, Warsh has long argued that the Fed’s independence should be limited to its congressional mandate and has criticized Powell for allowing the institution to engage in political issues such as climate change and diversity. He cautioned that viewing Warsh as a purely institutional figure may underestimate how closely his views align with Trump’s broader economic philosophy, even if that does not immediately imply aggressive interest rate cuts.