U.S. factory-equipment maker OTC Industrial Technologies has long relied on low-cost countries like China and then India for component sourcing. But the blitz of tariffs imposed by President Donald Trump on many trade partners has disrupted the supply-chain logic, says CEO Bill Canady.

“We moved things out of China and into other countries, and now the tariffs on those are as bad or worse,” Canady told Reuters. “We just have to hang on and navigate our way through this so we don’t all go broke in the short run.”

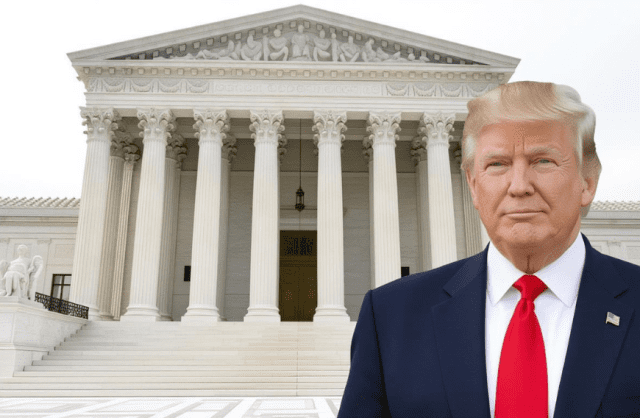

This dilemma is resonating across companies, trade ministries, law firms and economists as the U.S. Supreme Court weighs the legality of Trump’s global tariffs, with arguments scheduled for Wednesday. Under one legal authority or another, those tariffs are expected to remain long-term.

Lower courts ruled against Trump.

The Supreme Court, which features a 6-3 conservative majority that has backed Trump in key decisions this year, is reviewing the administration’s appeal after lower courts found the president exceeded his authority when imposing sweeping tariffs under a law designed for emergencies.

A ruling invalidating Trump’s use of the 1977 International Emergency Economic Powers Act (IEEPA) would remove a key tool for penalising countries on non-trade political issues. These have ranged from Brazil’s prosecution of former president Jair Bolsonaro to India’s purchases of Russian oil that support Russia’s war in Ukraine.

“For decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike,” Trump said in April, announcing sweeping reciprocal tariffs under IEEPA. “Reciprocal – that means they do to us and we do it to them.”

Trump is the first U.S. president to invoke this statute for tariffs. The law gives the president wide authority to regulate economic transactions during a declared national emergency. In this case, Trump said a $1.2 trillion U.S. goods-trade deficit in 2024 constituted a national emergency – despite the U.S. running trade deficits every year since 1975 – and also referenced fentanyl overdoses.

U.S. Treasury Secretary Scott Bessent expects the Supreme Court to uphold the IEEPA-based tariffs. But if the court strikes them down, the administration can pivot to other authorities like Section 122 of the Trade Act of 1974 (which allows broad 15 % tariffs for 150 days) or Section 338 of the Tariff Act of 1930 (permitting up to 50 % tariffs on nations that discriminate against U.S. commerce). “You should assume they’re here to stay,” Bessent said of the tariffs.

For nations that secured tariff-reducing trade deals under Trump: “You should honour your agreement,” he added. “Those of you who got a good deal should stick with it.”

Trump’s administration is already applying other tools, such as Section 232 of the Trade Expansion Act of 1962 (for national-security tariffs covering autos, semiconductors, robotics and aircraft) and Section 301 of the Trade Act of 1974 (for unfair-trade practices investigations). “This administration is committed to tariffs as a cornerstone of economic policy, and companies and industries should plan accordingly,” said Tim Brightbill, co-chair of the trade-law practice at Wiley Rein.

Negotiating power and investment concerns.

The Trump administration highlights tariffs as leverage to force major partners such as Japan and the European Union to make concessions that could reduce the U.S. trade deficit and survive any court ruling.

Trade partners aren’t waiting on the Supreme Court. The U.S. Trade Representative’s office finalised framework deals with Vietnam, Malaysia, Thailand and Cambodia, locking in tariff rates of 19 %-20 %. South Korea agreed to a $350 billion-investment plan in exchange for a 15 % tariff on its cars and goods.

Negotiations with China remain harder due to its willingness to retaliate and cut off rare-earth supplies that feed U.S. high-tech manufacturing. Instead of big concessions, the administration accepted a temporary truce: in South Korea, Trump and Chinese President Xi Jinping agreed to halve the U.S. tariff on Chinese goods tied to fentanyl to 10 % and postpone tighter tech-export controls for a year in exchange for China pausing tougher rare-earth licensing.

Revenue, inflation and business pain.

Investors warn markets are used to the tariff status-quo, and a Supreme Court strike-down could throw the Treasury debt market into turmoil. One major risk: refunding over $100 billion in IEEPA tariff collections and losing hundreds of billions in annual revenue. These IEEPA tariffs accounted for the bulk of a $118 billion rise in net customs receipts in fiscal 2025, which helped slightly reduce the U.S. deficit to $1.715 trillion.

“It’s a significant political-economy risk that we get addicted to tariff revenue,” said Ernie Tedeschi of the Yale University Budget Lab. Returns would be hard: a tariff reversal of this scale is unprecedented for the U.S. Customs and Border Protection agency, said Angela Lewis, global head of customs at freight-forwarder and broker Flexport. For many importers, refunds requiring “post-summary corrections” may not be worthwhile — and U.S. taxpayers could face 6 % annual interest compounded daily.

The biggest dilemma is cost-management. Importers have largely absorbed tariffs to protect market share, narrowing profit margins but limiting consumer-price increases. According to Oxford Economics, tariffs alone added 0.4 percentage point to September’s Consumer Price Index annual rate of 3.0 %, keeping inflation above the Federal Reserve target. So far, global companies have flagged over $35 billion in tariff-related costs ahead of Q3 earnings.

Ohio-based OTC designs production lines and automation systems. CEO Canady says companies like his will soon have to “place their bets” on where to shift production for a lasting cost base — possibly back to U.S. shores for high-end goods, and to Mexico for lower-value parts. “I think the new normal is going to be 15 %,” Canady said of Trump’s tariffs, “regardless of the legal authority he invokes. They’ll call it whatever they need so it isn’t challengeable.”