BitMine’s Tom Lee Predicts Strategy Could Become World’s Largest Company if Bitcoin Hits $1M

Tom Lee, Chairman of BitMine, has made a striking forecast: Strategy—formerly MicroStrategy—could eventually become the largest publicly traded company if Bitcoin reaches the $1 million mark. In a recent podcast, Lee praised founder Michael Saylor’s unorthodox yet aggressive investment strategy, which centers on holding Bitcoin as the company’s primary reserve asset instead of cash.

Lee compared Strategy’s model to that of ExxonMobil, which dominated the S&P 500 for decades not because of net income, but due to the rising value of oil. Similarly, he believes Strategy’s value lies not in its earnings, but in the appreciating value of its Bitcoin holdings.

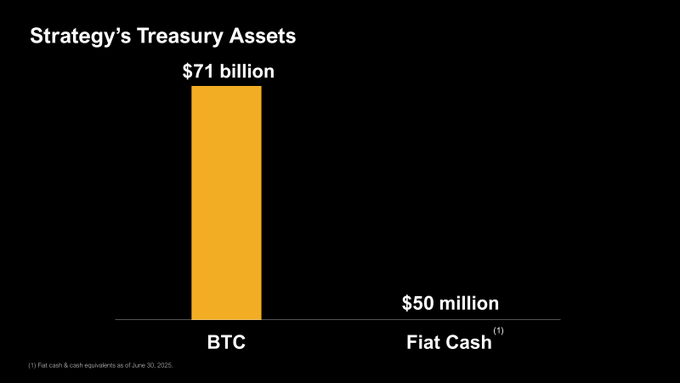

Currently, Strategy holds 628,791 BTC, acquired at a cost of $46.08 billion. At today’s prices, that stash is worth around $71 billion. The company recently filed a $4.2 billion STRC offering, planning to reinvest the proceeds directly into Bitcoin—doubling down on its “all-in” BTC strategy. Notably, Strategy holds just $50 million in fiat, further reinforcing its commitment to Bitcoin as its primary reserve.

Despite this ambitious vision, Strategy has a long road ahead. With a market cap of $2.52 billion and a stock price near $380, it still trails giants like NVIDIA ($4.3 trillion) and Microsoft ($3.9 trillion). However, its Bitcoin-centric approach has already positioned it ahead of major firms like PayPal and ExxonMobil in terms of U.S. corporate crypto treasury size.

Meanwhile, BitMine itself is following a similar path—though focused on Ethereum instead of Bitcoin. It currently holds 833,100 ETH, making it the largest public holder of Ethereum, much like Strategy’s dominance in the Bitcoin space.

Lee’s bold prediction signals a broader shift in how company value may be measured in the digital age—where asset appreciation, not just traditional earnings, could define the next generation of corporate giants.