Peter Brandt Predicts Bitcoin Could Reach $327K Despite Short-Term Volatility Concerns

Highlights:

- Peter Brandt outlines two scenarios for Bitcoin’s price trajectory, with targets of $134K and $327K.

- The most bullish case predicts BTC hitting $327K in the near future.

- Short-term volatility due to US CPI inflation and macroeconomic factors may impact Bitcoin’s momentum.

Bitcoin’s recent rally has temporarily paused as investors shift focus to the upcoming US CPI inflation data. Market experts anticipate a potential short-term pullback before a renewed upward move in the coming days. Despite these concerns, veteran trader Peter Brandt remains optimistic, projecting a bullish outlook for Bitcoin’s price.

Bitcoin Price Could Reach $327K, Says Peter Brandt

In a recent post on X, Peter Brandt shared his analysis of Bitcoin’s price potential, presenting two possible scenarios. According to his chart, BTC could either rise to $134K or hit a high of $327K in the most bullish case.

Brandt noted that some analysts view Bitcoin as overbought, which could result in a target of $134K. However, others argue that Bitcoin is in the early stages of a bull run, potentially pushing its price to $327K.

His analysis highlights both bullish and bearish possibilities, with the higher target of $327K capturing significant investor interest. Brandt’s chart suggests Bitcoin could experience substantial volatility, but a breakout might push it beyond its previous all-time highs.

Factors Supporting a Potential Bitcoin Rally

While the $134K target appears more realistic in the short term, the longer-term outlook supports the possibility of Bitcoin reaching $327K. A clearer regulatory framework in the U.S., along with a pro-crypto stance from regulatory bodies under Donald Trump, could sustain the current market rally.

Brandt’s forecast aligns with predictions from Bernstein analysts, who have similarly projected a surge in Bitcoin’s value. Additionally, Brandt recently predicted a $200K price target for BTC, further solidifying his bullish stance.

Challenges Bitcoin May Face

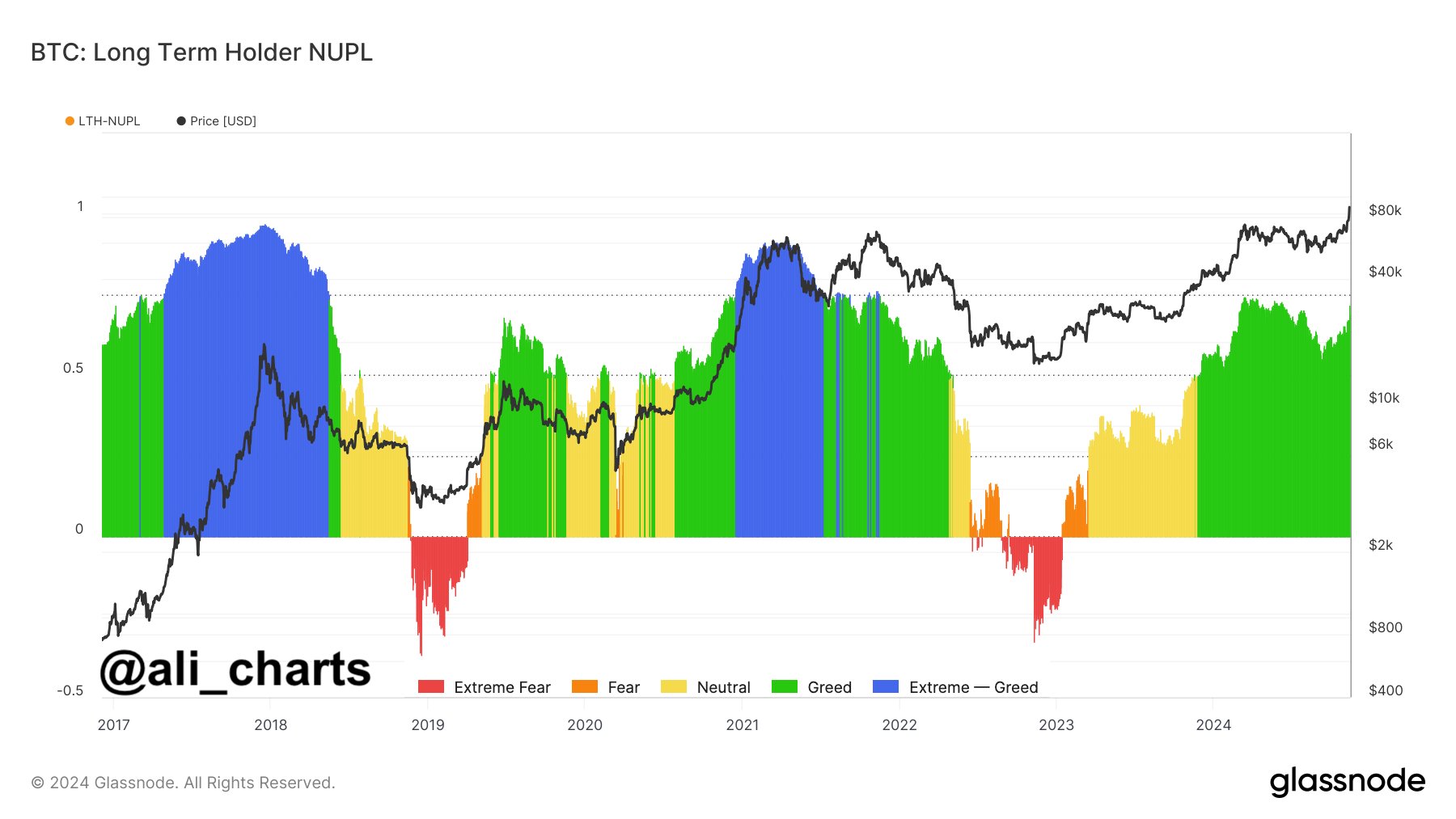

Despite Brandt’s optimistic view, other analysts have expressed caution, citing short-term volatility driven by US CPI data and other macroeconomic factors. Crypto analyst Ali Martinez noted that long-term Bitcoin holders are not displaying “extreme greed” despite recent price increases, indicating cautious market sentiment.

This restraint among long-term holders suggests confidence and stability in the market, though Martinez expects a gradual momentum buildup rather than an immediate surge.

Near-Term Outlook

Bitcoin’s near-term performance will likely be influenced by US CPI inflation data and its impact on investor sentiment. Experts anticipate a brief pullback as traders adjust to economic updates and prepare for potential interest rate changes from the Federal Reserve.

As of today, Bitcoin’s price has dipped over 2%, trading at $87,540 with a 24-hour high of $89,915. Despite this decline, Bitcoin remains near its recent all-time high of $89,956, indicating strong market support. However, BTC Futures Open Interest dropped by 3% in the last 24 hours, suggesting investors are holding back ahead of key economic announcements.

While short-term volatility remains a concern, Bitcoin’s long-term outlook remains bullish, with many expecting new highs in the months to come.