Peter Brandt forecasts a potential XRP crash, stirring concerns among investors.

XRP Struggles in “Uptober”: Legal Issues and Market Volatility Weigh on Price

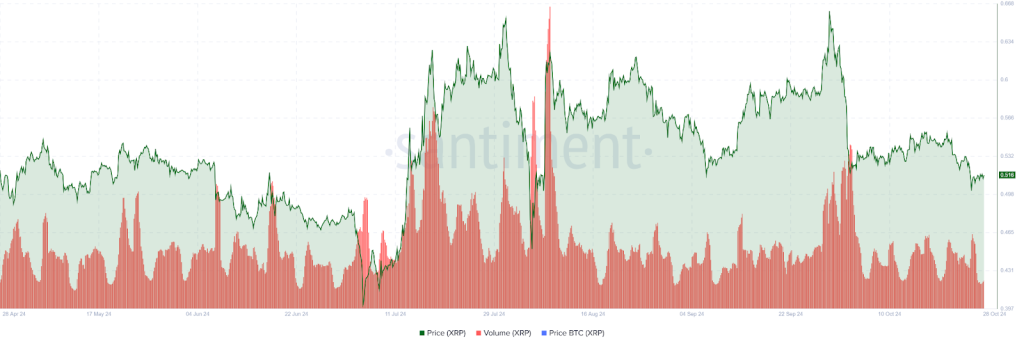

XRP, a leading altcoin, faces tough market conditions as investor confidence wavers. The cryptocurrency remains stuck below the $0.55 resistance, having recently dropped 13% in the past month and 7% over the last week. Now trading at $0.5143 with a 7% decline in 24 hours, XRP’s trading volume has risen by 5%, yet bearish sentiment persists, fueled by Ripple’s ongoing legal issues.

Adding to the uncertainty, respected trader Peter Brandt recently issued a stark prediction for XRP, highlighting a multi-year head-and-shoulders (H&S) pattern forming over the last decade, which he believes could result in a severe price drop, potentially nearing zero against Bitcoin. Brandt warns that if the pattern unfolds, XRP’s market relevance could diminish, with community interest waning as prices fall.

Brandt didn’t stop at his market prediction. Known for his blunt social media presence, he recently referred to Ripple as “RIP PPL OFF” due to its ongoing legal troubles, suggesting that XRP’s value could potentially fall to $0.20 or lower. This stance has divided the XRP community, with some investors seeing his outlook as overly negative, while others express caution over XRP’s uncertain future.

October’s Volatility for XRP:

October 2024, often called “Uptober” in crypto circles, has thus far disappointed XRP holders. Despite optimism for a rebound, XRP remains volatile, with significant liquidation levels at key price points. Some analysts point to potential market manipulation around these zones, though a clear recovery trend has yet to emerge.

With Ripple’s legal challenges and Brandt’s bearish outlook, XRP faces a difficult journey ahead. While many supporters remain hopeful amid market uncertainty, some analysts predict a possible drop to the $0.20 range.