In the cryptocurrency market, competition is constant, and investors are always seeking new opportunities with high potential. Recently, Wintermute transferred 42M USDT to Binance, signaling an increase in liquidity as market makers sent stablecoins to exchanges. Although stablecoin inflows and reserves remain low overall, this activity is catching traders’ attention, especially as FDUSD printing has accelerated over the past two days, hinting at potential price movements on Binance.

Stablecoin inflows to exchanges have increased liquidity by about $100M, coinciding with a decline in crypto prices, with BTC dipping to around $60,000. These inflows may indicate new buying opportunities as large market makers are positioning themselves to influence the market. Wintermute, for instance, deposited 42M USDT in a series of regular transfers, while other key players like Flow Traders and Carrot_BTC have made significant deposits.

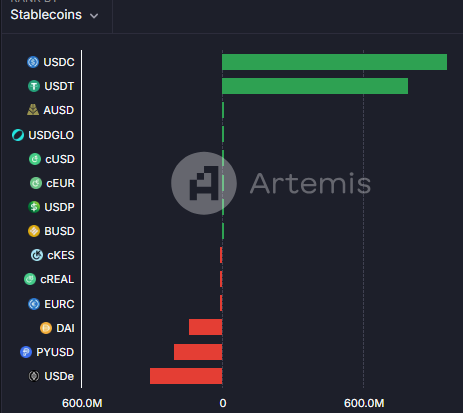

Although exchange flows for stablecoins have been negative over the past week, the recent deposits suggest a reversal, potentially signaling increased buying pressure. Stablecoin reserves on exchanges remain at $26.13B, while a significant portion of stablecoins has moved onto L2 protocols, complicating liquidity tracking.

Stablecoin volumes have grown, particularly for USDT and USDC, which saw increased inflows and supply growth. USDT’s supply expanded by 792M tokens, while USDC saw a net increase of $959.4M, with new minting on platforms like Base. Some stablecoin inflows to Binance may be tied to the Scroll ZKP token Launchpad program, which could attract whales seeking rewards from the airdrop.

The overall stablecoin supply is rising, with Tether’s supply increasing to 119.7B, and FDUSD showing notable growth in recent days, reaching $3.2B in value. FDUSD, a highly active asset with significant turnover, may have a disproportionate market impact compared to other stablecoins. Meanwhile, GHO by Aave has also expanded, adding 18.3% to its supply in the last month, positioning itself for potential market influence.

These inflows suggest that market makers are preparing for potential market shifts, while stablecoin liquidity continues to expand across exchanges and L2 protocols.