Solana is poised for a potential breakout, with market analyst Edward suggesting that its narrow consolidation range could lead to a significant price surge. He predicts that SOL could experience 2x to 5x growth by the end of 2025, driven by organic growth and its strong position in the DeFi ecosystem.

Experienced traders believe Solana’s price could rise substantially, with the potential to reach previously unattainable levels, possibly surpassing $150. By 2025, Solana is expected to play a larger role in the blockchain space, contributing to its adoption and price growth.

In a TradingView analysis, Edward noted that although SOL is showing some short-term uncertainty, a breakout could occur soon. Currently, SOL is trading between $143.33 and $144.88, with a 5.34% increase. The price is testing key support and resistance levels, and traders are closely watching for a breakout. If SOL breaks above the 34-period and 89-period exponential moving averages (EMAs), it could signal a bullish shift in market sentiment.

Edward outlines two possible scenarios: a bullish breakout above $144.70 could push SOL toward the $150.54 resistance level, while a bearish move below $143.33 could trigger a pullback to $137.25, forming a critical support zone.

According to analyst Geoff Kendrick, broader market factors, including the outcome of the 2024 U.S. presidential election, could also influence SOL’s future. He predicts that if Donald Trump wins the election, SOL could see a 500% surge due to potentially less stringent crypto regulations. Additionally, the approval of a Solana spot ETF could further drive demand.

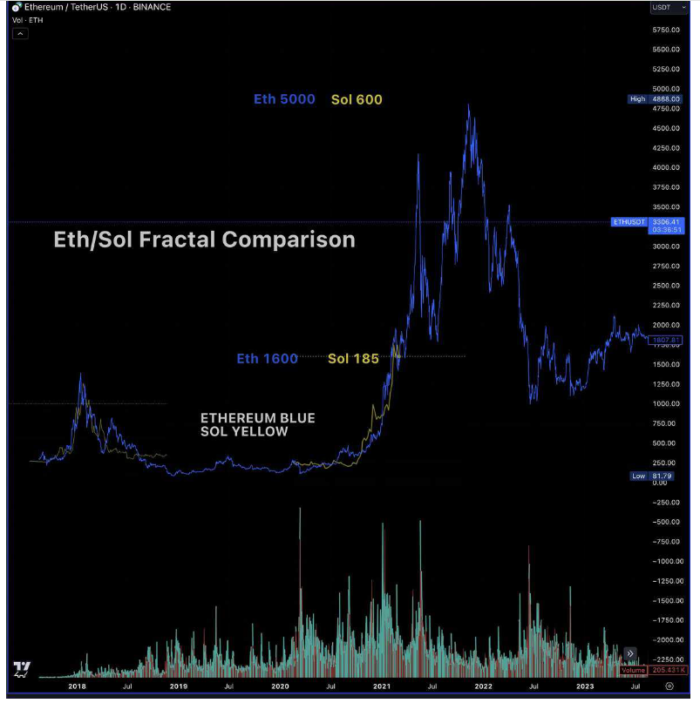

Crypto analyst MartyParty has drawn comparisons between Solana’s current performance and Ethereum’s 2020 trajectory, predicting a 3.2x increase that could push SOL’s price to $600 in the next major market cycle.

Despite some bearish market sentiment, rising trading volume and open interest suggest a potential shift in Solana’s price trend. According to market intelligence platform Santiment, Solana’s recent price struggles may be due to negative crowd sentiment, but historical patterns indicate a recovery could be on the horizon.