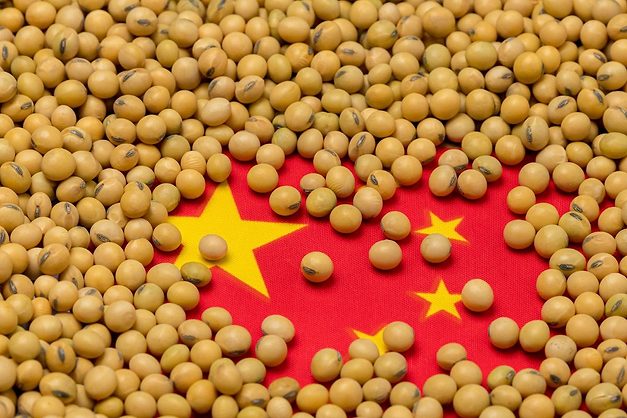

China Buys Argentine Soybeans After Tax Cut, Leaving US Farmers at a Loss

Chinese buyers booked at least 10 cargoes of Argentine soybeans after Buenos Aires scrapped grain export taxes on Monday, traders said. The move delivers another setback to U.S. farmers, who are already struggling with weak prices and limited access to their top export market.

Argentina Gains an Edge With Temporary Tax Break

Argentina’s suspension of soybean export taxes boosted competitiveness, prompting Chinese traders to secure cargoes for fourth-quarter delivery. This period is usually dominated by U.S. shipments, but trade tensions between Washington and Beijing have shifted demand to South America.

The deals involve Panamax-sized shipments of about 65,000 metric tons each, scheduled for November. Prices were quoted at a premium of $2.15–$2.30 per bushel above the CBOT November soybean contract. One trader noted that Chinese buyers may have booked as many as 15 cargoes.

US Farmers Miss Out on Key Market

These purchases are a major blow for U.S. farmers, who normally sell billions of dollars’ worth of soybeans to China during this season. With trade talks stalled and South American suppliers like Brazil filling the gap, U.S. exports remain frozen.

China, the world’s largest soybean importer, has not booked any U.S. shipments from the autumn harvest so far. This comes despite a recent phone call between President Donald Trump and President Xi Jinping, which offered no progress on agriculture.

Market Impact and Price Reaction

Argentina’s tax break is temporary, set to last through October or until declared exports hit $7 billion. The news drove Chinese soymeal and soybean oil futures down 3.5% on Tuesday, reflecting cheaper prices and stronger crushing margins for Chinese buyers.

Analysts say the impact may be short-lived, as Argentina’s supply remains limited. Still, China’s soybean imports hit record highs from May through August, building inventories ahead of possible fourth-quarter disruptions.

Looking forward, analysts highlight three key factors: actual Argentine shipments, U.S.-China trade negotiations, and how these dynamics will shape China’s soybean demand through early next year.