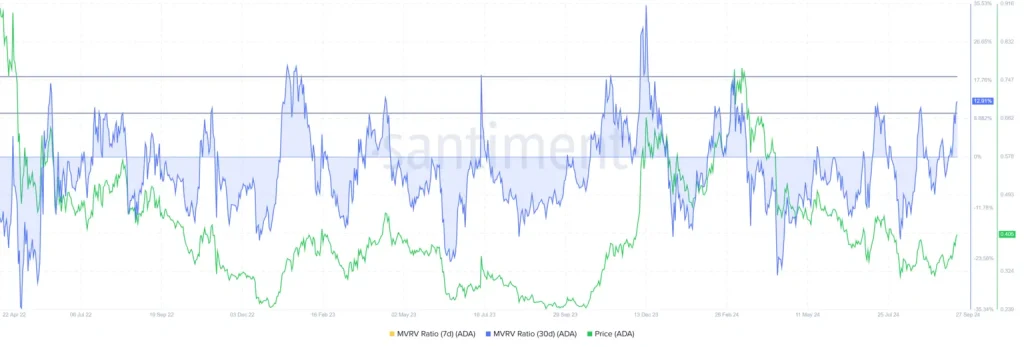

Cardano (ADA) has surged 15% to reach $0.40, marking a two-month high. However, two key indicators suggest potential challenges ahead. The Market Value to Realized Value (MVRV) ratio has entered the “danger zone” at 13%, indicating that many ADA holders are in profit and may soon take profits, which could lead to selling pressure. Historically, when the MVRV ratio is between 10% and 18%, investors often liquidate, causing price rallies to stall or reverse.

Additionally, Cardano’s Relative Strength Index (RSI) is nearing overbought levels, signaling that ADA’s recent bullish momentum may be overextended and a market correction could follow. Despite these warning signs, ADA’s upward trend since mid-September remains intact, with a potential target of $0.46 if it can surpass resistance at $0.42. Failure to maintain current levels, however, could see the price drop to $0.37 or even $0.34 if key support levels do not hold.