Bitcoin ETFs saw $541 million in outflows on November 4, marking their second-largest single-day outflow, as investors brace for the U.S. 2024 election’s potential market impact.

Highlights:

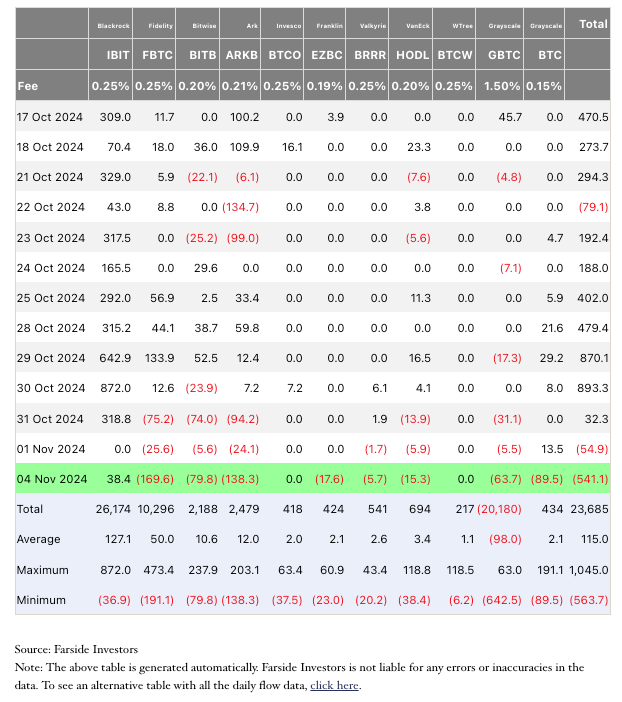

- U.S. spot Bitcoin ETFs recorded a net outflow of $541.1 million on Nov. 4, their second-largest daily decline.

- These outflows reflect investor caution amid shifts tied to the U.S. election.

- Bitcoin currently trades at $68,700, with cautious sentiment persisting.

On November 4, Bitcoin ETFs experienced significant outflows totaling $541 million, amid heightened uncertainty surrounding the upcoming U.S. election. Fidelity’s FBTC led the outflows with a $170 million withdrawal, followed by ARKB with $138 million and BITB with $80 million. This trend underscores a careful stance from investors anticipating potential volatility tied to the election and Federal Reserve decisions.

Record Outflows Ahead of U.S. Election

The sharp outflows from Bitcoin ETFs highlight growing investor caution amid rising political and economic uncertainty in the U.S. With the November 5 election showing a close race, pro-crypto candidate Donald Trump holds a narrow edge in some metrics, increasing market unpredictability. Fidelity’s substantial outflows signal a broader caution that could influence trends across other ETFs.

Bitcoin ETF Outflows: $541M Signals Caution Before Election

Alongside Fidelity, Ark Invest’s ARKB and Bitwise’s BITB reported major outflows of $138 million and $80 million, respectively, while Grayscale’s Bitcoin Trust saw $153 million in combined BTC and GBTC withdrawals. In contrast, BlackRock’s IBIT stood out with net inflows of $38 million, potentially indicating investor preference for perceived stability within certain funds.

Bitcoin Price Dips as Volatility Rises

Amid ETF outflows, Bitcoin’s price fell to $68,700, marking a 0.5% drop over the past day. Spot prices dipped to $67,300 over the weekend, signaling a cautious market sentiment ahead of key U.S. events. The price of Bitcoin has declined by nearly 3.21% over the last week, according to CoinMarketCap.

Bitcoin’s trading volume and open interest data suggest a mixed market outlook. CoinGlass data shows open interest rising by 1.17% over the past 24 hours, with trading volume jumping 23.57% to $42 billion. Bitcoin’s market cap now stands at $1.36 trillion, indicating sustained engagement even as caution prevails. Analysts expect continued shifts in volume and open interest, with volatility likely influenced by the election outcome and the Federal Reserve’s policy update on November 6. Historically, Bitcoin has often seen significant post-election gains, with notable increases following the 2012, 2016, and 2020 elections, though short-term trends may hinge on this year’s results.