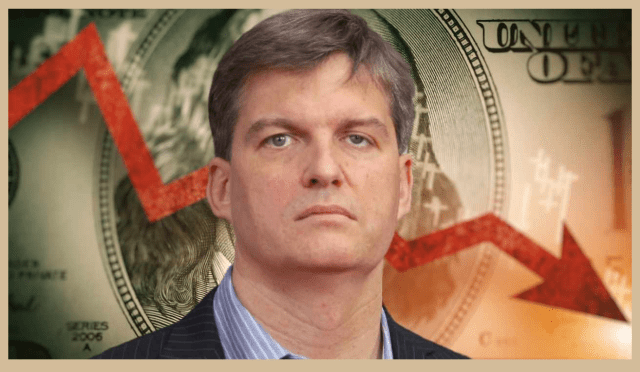

‘Big Short’ Investor Michael Burry Breaks Silence With Fresh Market Bubble Warning

Michael Burry, the legendary investor known for predicting the 2008 subprime mortgage crisis, made a surprise return to social media on Thursday after nearly two years of silence — posting a cryptic message about market bubbles.

In a post on X (formerly Twitter), Burry wrote:

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

The post included an image of Christian Bale, who portrayed Burry in the Oscar-winning film The Big Short.

Burry’s Warning Sparks Speculation Over AI Bubble

Burry did not specify which market bubble he was referring to, but many analysts believe his comment could relate to growing speculation around a potential artificial intelligence (AI) bubble.

Recent concerns about AI-driven overvaluation have intensified after NVIDIA Corporation (NASDAQ:NVDA) hit a record $5 trillion valuation, fueled by optimism surrounding its investments in OpenAI, one of its biggest customers. Critics warn this tight relationship could signal circular financing, where companies’ valuations feed each other artificially.

Despite these concerns, Nvidia shares continued to rise, supported by improving U.S.-China trade relations and strong chip demand.

Burry’s History of Market Warnings

This post marked Burry’s first public comment in nearly two years, reigniting interest among investors who closely follow his market views.

The Scion Asset Management founder famously predicted and profited from the 2008 financial crash, a story dramatized in The Big Short. In 2021, he also warned of speculative bubbles in meme stocks and cryptocurrencies, both of which later experienced sharp corrections.

More recently, Burry was seen taking large positions in Chinese tech giants including Alibaba Group (NYSE:BABA), JD.com (NASDAQ:JD), and Baidu Inc (NASDAQ:BIDU) through his hedge fund.

These bets likely yielded strong returns this year as Chinese technology stocks rallied following the release of DeepSeek in February, which boosted investor confidence in China’s AI sector.