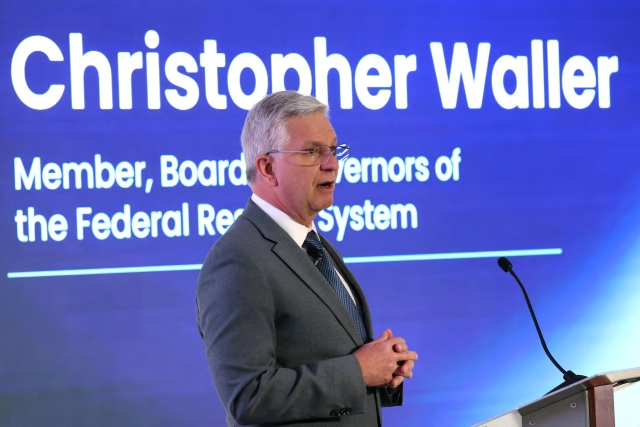

U.S. interest rates remain above their theoretical neutral level, while inflation is expected to continue easing in the months ahead, according to Federal Reserve Governor Christopher Waller.

In an interview with CNBC, Waller said the Fed’s current policy rate may be around 50 to 100 basis points above neutral — the level at which borrowing costs neither stimulate nor restrain economic growth.

He added that policymakers still have flexibility to ease further, noting that there remains room to lower rates if economic conditions warrant it.

Fed signals openness to additional easing

Waller’s comments follow the Federal Reserve’s decision last week to cut interest rates by 25 basis points, bringing the benchmark range to 3.50%–3.75%. The move was framed as support for the labor market, even as inflation pressures remain sticky but stable.

Recent economic data, released with delays due to the record-long U.S. government shutdown and therefore not included in the Fed’s December meeting, showed stronger-than-expected job creation in November. However, the unemployment rate rose slightly faster than forecasts.

Looking ahead, uncertainty remains over the Fed’s next steps in early 2026. According to CME Group’s FedWatch Tool, markets currently price in roughly a 73% probability that interest rates will remain unchanged at the Fed’s January meeting.

Labor market remains Waller’s main concern

Waller emphasized that his primary focus remains the labor market, which he described as “very soft.” He said recent nonfarm payroll gains averaging around 50,000 to 60,000 jobs per month are likely overstated and could eventually be revised down closer to zero growth.

He also noted that many business leaders have paused hiring as they assess which roles could potentially be replaced by artificial intelligence. According to Waller, this slowdown may be temporary once greater clarity emerges.

Despite weaker employment conditions, Waller said he does not expect inflation to reaccelerate. He pointed to market-based measures, inflation expectations and Treasury Inflation-Protected Securities as evidence that price pressures are likely to continue cooling.

He also downplayed concerns that broad U.S. tariffs could drive sustained inflation, arguing that their impact would likely be a one-time price adjustment rather than a persistent inflationary force.

Fed leadership speculation adds political backdrop

Waller’s remarks come amid reports that President Donald Trump is considering him as a candidate to succeed Jerome Powell as the next Federal Reserve Chair. Powell’s term is scheduled to end in May.

According to the Wall Street Journal, Trump is expected to interview Waller, though former Fed Governor Kevin Warsh and White House economic adviser Kevin Hassett are reportedly viewed as the president’s leading choices.

Waller, who was appointed to the Fed’s board by Trump and confirmed by the Senate in 2020, has emerged this year as one of the strongest advocates for rate cuts. While he is seen by many on Wall Street as a credible successor, the report suggests he may be a longer shot due to weaker personal ties with the president compared to other candidates.

Waller said he would place a strong emphasis on preserving the Federal Reserve’s independence from the White House, stressing that central bank autonomy remains essential for effective monetary policy.