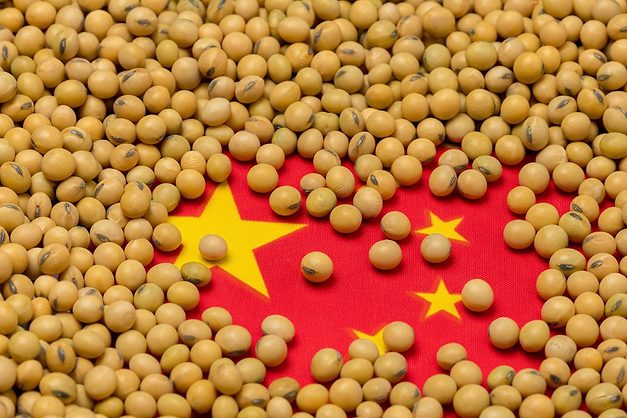

China’s soybean importers are ramping up purchases from Argentina and Uruguay over the next year to compensate for reduced U.S. supplies, as the trade war between Washington and Beijing continues, two trade sources told Reuters.

Chinese processors may buy as much as 10 million metric tons of soybeans from the two South American exporters during the 2025/26 marketing year ending next August — a potential record. So far, 2.43 million tons have already been booked for shipment between September and May, the sources said.

From September 2024 to July 2025, China imported 5 million tons of soybeans from Argentina and Uruguay, according to customs data. This growth comes alongside continued heavy purchases from Brazil, further eroding U.S. exporters’ share of the Chinese market.

For the fourth quarter of 2025, a key sales period for American farmers, China has not booked any U.S. soybean cargoes. Traders said the shift underscores Beijing’s long-term strategy to reduce reliance on U.S. farm products and strengthen food security.

By mid-August, Chinese buyers had secured 1.575 million tons for September shipments from Argentina and Uruguay, 660,000 tons for October, and smaller loads for November, December, and May 2026.

The U.S. once supplied 20% of China’s agricultural imports in 2016, but that share fell to 12% in 2024. In contrast, Brazil’s share rose to 22% from 14% over the same period. The growing role of Argentina and Uruguay reflects both bumper harvests and the absence of U.S. sales.

Argentina harvested 50.9 million tons of soybeans in 2024/25, up from 48.2 million a year earlier and more than double the 25 million tons gathered during the drought-hit 2022/23 season, USDA data showed. Uruguay’s output also climbed to 4.2 million tons from 3.3 million the previous year.

The increased supply from South America highlights how China is reshaping its agricultural trade relationships while the U.S.-China tariff war drags on.