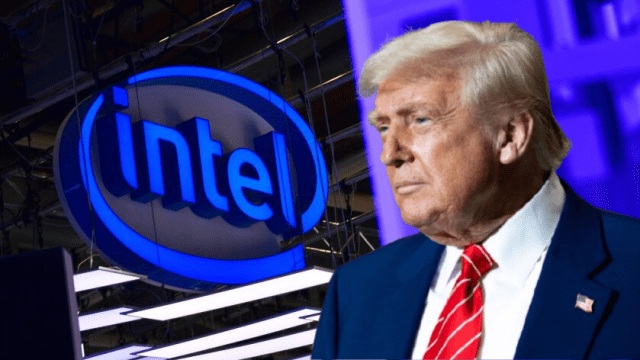

Intel received $5.7 billion in cash on Wednesday evening, part of a deal negotiated by U.S. President Donald Trump, which gives the government a 10% stake in the chipmaker, finance chief David Zinsner said at an investor conference Thursday.

The stake, announced last week, is designed to incentivize Intel to keep control of its contract manufacturing arm, or foundry. As part of the agreement, the U.S. government also secured a 5% warrant in case Intel’s ownership of its foundry unit falls below 51%.

“I don’t think there’s a high likelihood we would take our stake below 50%,” Zinsner said, adding that he expects the warrant “to expire worthless.”

Intel has already taken steps to separate its foundry operations from its chip design business. The company has hinted it may accept outside investment in the foundry but stressed it would prefer a strategic partner over a purely financial investor. However, Zinsner noted that such a move remains “years away.”

In July, Intel disclosed that the future of its foundry business hinges on securing a major customer for its next-generation 14A manufacturing process. Without such demand, Intel may exit the foundry business altogether.

On Thursday, Zinsner sought to downplay the risks, saying that disclosures often emphasize potential challenges for legal reasons. Still, he admitted that investments in the 14A process solely for Intel’s internal use would not generate sufficient returns for shareholders.

Intel remains focused on landing a large external customer next year while maintaining financial discipline. Despite the cash injection, Intel shares slipped 0.6% to $24.69 on Thursday afternoon.