Fed Rate Cut Seen as Almost Certain After Inflation Data and Bessent Remarks

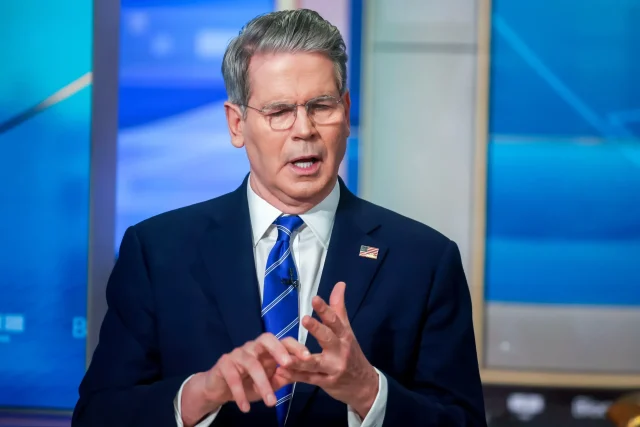

The likelihood of a Federal Reserve rate cut in September is now close to 100%. This follows new data showing U.S. inflation rose at a moderate pace in July and comments from Treasury Secretary Scott Bessent, who suggested a possible aggressive half-point cut due to weak job growth.

On Wednesday, traders in federal funds rate futures placed the odds of a quarter-point cut at the September 16–17 Fed meeting at 99.9%, according to the CME FedWatch Tool. The shift came after the release of July Consumer Price Index (CPI) data on Tuesday and Bessent’s remarks. He noted the Fed used similar labor market concerns to justify a larger cut in September last year.

Former President Donald Trump has criticized last year’s cut as politically motivated, given its proximity to the November election. The Fed reduced rates at three meetings in late 2024 — September, November, and December — before pausing.

Fed Chair Jerome Powell will speak next week at a central bank research conference in Wyoming. Last year, he used the same forum to signal future rate cuts, pledging to support a strong labor market while working toward the Fed’s 2% inflation target.

At that time, the unemployment rate had risen by about 0.75 percentage points over the prior year. It has remained largely unchanged since. But recent Bureau of Labor Statistics (BLS) data shows job growth slowed sharply in May, June, and July, contradicting earlier, stronger estimates. Bessent argued that if the weaker data had been available earlier, the Fed might have cut rates in June and July.

Bessent said there is “a very good chance” of a 50 basis-point cut in September, arguing that rates are “too restrictive” and should be 150–175 basis points lower.

Powell’s Future and Trump’s Expanded Candidate List

Bessent’s comments come as the Trump administration expands its list of potential replacements for Powell, whose term ends in May. The list now includes Philip Jefferson, Michelle Bowman, Christopher Waller, Lorie Logan, and Kevin Hassett, along with several private-sector candidates.

Current Council of Economic Advisers chair Stephen Miran is not expected to remain at the Fed beyond his interim term ending in January, even if confirmed by the Senate.

Bessent’s proposed cuts would lower the federal funds rate from 4.25–4.5% to around 3%, which is considered a “neutral” level that neither stimulates nor restricts the economy. This would align with the Fed’s comfort in inflation trending toward its 2% goal while maintaining full employment.

Inflation, Tariffs, and Policy Outlook

Fed officials remain cautious about declaring victory over inflation. Prices still exceed the target and may rise temporarily due to Trump administration tariffs. However, some policymakers now argue that tariff-related price increases are limited and that jobs data revisions increase the risk of unemployment.

Fed Vice Chair Bowman said on Saturday that moving policy closer to neutral now could prevent further labor market deterioration and avoid the need for sharper cuts later.

Analysts also note that tariffs’ costs are mostly being absorbed by domestic firms, not passed on to consumers. According to Citi analysts, this should ease Fed inflation concerns and support a series of rate cuts starting in September — potentially faster and deeper than markets currently expect.