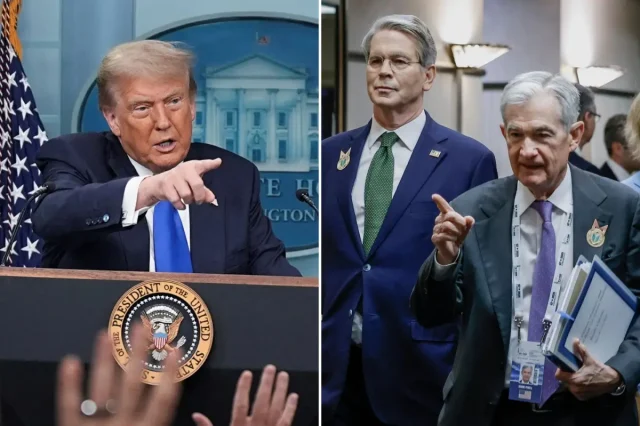

Trump Renews Attacks on Powell as Fed Eyes Cautious Path Forward on Rates

President Donald Trump on Monday ramped up his criticism of the Federal Reserve, again pressuring Chair Jerome Powell to cut interest rates sharply. Trump posted a note—complete with handwritten remarks—listing global interest rates and arguing that the U.S. rate should fall between Japan’s 0.5% and Denmark’s 1.75%. He told Powell he was, “as usual, too late.”

“You should lower the rate by a lot. Hundreds of billions are being lost,” Trump wrote, sharing the message on social media alongside a broader attack on the central bank: “Being a central banker in the U.S. is one of the easiest, yet most prestigious jobs in America, and they have FAILED… We should be paying 1% interest, or better!”

Such a low policy rate has historically been linked to periods of sluggish or even negative growth in the U.S. economy, raising concerns about Trump’s push. As with many of his past posts, Trump appeared to conflate the Fed’s benchmark short-term rate with longer-term market rates, which are influenced by broader factors such as inflation expectations, economic growth, and global risk sentiment.

With inflation still above the Fed’s 2% target and unemployment low, central bank officials have been hesitant to cut rates from the current 4.25%–4.5% range—especially with the looming July 9 tariff deadline, which could lead to renewed inflation pressure.

While Trump cannot directly fire Powell over policy differences, he publicly urged him to resign last week.

Meanwhile, Treasury Secretary Scott Bessent is quietly preparing for a transition in Fed leadership, with Powell’s term ending in May 2026. Bessent indicated he’s pursuing a traditional appointment process, rather than attempting to install a “shadow chair” in advance.

“There’s a seat opening up in January,” Bessent told Bloomberg TV, suggesting that person could be nominated to succeed Powell. Current Governor Adriana Kugler’s term ends in January, and Bessent said a nomination could come as early as October or November, allowing time for Senate confirmation.

Governor Christopher Waller, already on the Fed board, is among the contenders, while others like Kevin Warsh, a former governor, would need a seat to open before entering the process.

Economic Data and Tariffs in Focus

While Trump’s aggressive calls for rate cuts could complicate future confirmations—given the Fed’s commitment to independence—markets are increasingly betting that policymakers will begin easing on their own terms.

Investors broadly expect the Fed to cut rates in September, with more reductions to follow. Even Goldman Sachs, which had previously forecast the first cut at year-end, revised its view Monday and now sees the first cut in September, followed by a deeper easing cycle.

“We thought summer inflation would make it harder to cut sooner,” Goldman said, “but early signs suggest the inflationary effect of tariffs is smaller than expected, and disinflationary forces are stronger.”

Waller has indicated that rate cuts could come as early as July, though he emphasized that any acceleration in inflation would justify a pause.

The Fed’s next key data point arrives Thursday, when June’s nonfarm payrolls report is released. A weaker-than-expected reading could increase pressure for immediate easing. Inflation data is due next week.

Attention is also fixed on July 9, the expiration date for Trump’s temporary suspension of select tariffs. If no deal is reached, tariffs could rise sharply, further complicating the inflation outlook.

On Monday, Atlanta Fed President Raphael Bostic reiterated his view that just one rate cut in 2025 may be appropriate. “There’s no urgency,” he said. “The labor market remains strong. This is more a matter of ‘when,’ not ‘if.’ We still need time to see how things unfold.”