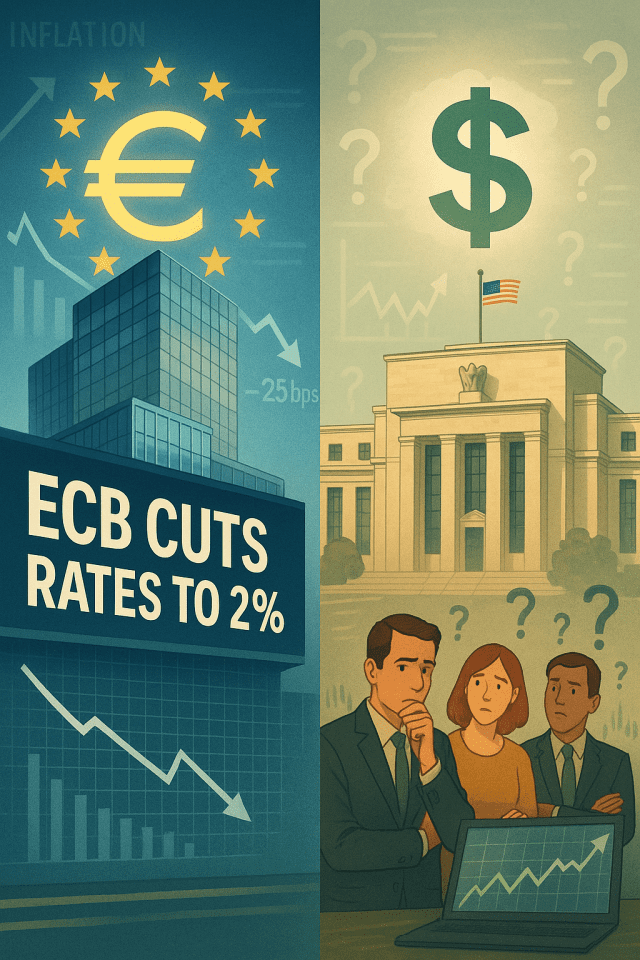

ECB Lowers Interest Rates as Inflation Cools, Raising Hopes for Similar Action by the US Fed

Key Points:

- The European Central Bank (ECB) has reduced interest rates in response to easing inflation.

- A 25 basis point rate cut aims to stimulate Europe’s economy.

- Investors are increasingly hopeful that the US Federal Reserve may follow suit with rate reductions.

In a significant monetary policy move, the ECB has announced a 25 basis point cut to key interest rates, citing a slowdown in inflation across the Eurozone. This decision, intended to spur economic growth, has fueled speculation that the US Federal Reserve might take similar action.

ECB Implements 25bps Rate Cut

The ECB’s Governing Council has lowered interest rates by 25 basis points, affecting the deposit rate, main refinancing operations, and marginal lending. These now stand at 2.00%, 2.15%, and 2.40%, respectively. The bank attributes the move to updated inflation projections, which currently hover near the ECB’s 2% target. Despite global trade uncertainties, economists expect an uptick in EU GDP growth.

Following recent trade tensions, including a 50% tariff imposed by former President Trump on EU imports in April, the situation has since de-escalated. Both the EU and US have now entered negotiations to forge a trade agreement, providing further economic stability.

However, the crypto market did not respond positively to the ECB’s rate cut. Bitcoin has dropped nearly 2%, and the total cryptocurrency market has declined by $30 billion in the past 24 hours.

Will the US Federal Reserve Follow the ECB’s Lead?

Attention now turns to the US, where there is increasing pressure on the Federal Reserve to reduce interest rates. While the ECB has already implemented multiple rate cuts, the Fed, led by Jerome Powell, remains cautious.

The ECB cited declining inflation as its rationale, a trend also reflected in the US, where CPI data shows inflation has fallen to 2.3%—the lowest since 2021. In addition, Core Producer Price Index (PPI) figures also indicate waning inflationary pressures.

Speculation around a possible Fed rate cut intensified following a recent meeting between Powell and Trump. Still, minutes from a Federal Open Market Committee (FOMC) session suggest the Fed is maintaining a conservative approach due to ongoing tariff-related uncertainty.

According to CME FedWatch, there is a 99% probability that the Fed will keep its benchmark interest rate between 4.25% and 4.50%. As the FOMC meeting nears, Powell has yet to comment on the Fed’s economic outlook.