MicroStrategy Faces Risks If Bitcoin Falls Below Acquisition Cost

MicroStrategy’s ongoing Bitcoin accumulation strategy has made it one of the largest BTC holders globally, with 580,955 BTC currently worth over $61 billion. However, concerns are growing about what might happen if Bitcoin’s market value drops below the company’s average purchase price of $70,000.

What’s at Stake?

According to a recent SEC filing, MicroStrategy may be forced to sell some of its Bitcoin holdings if their market value drops significantly below the acquisition cost. This situation could mirror the 2022 FTX crash, leading to panic selling across the broader crypto market.

Despite the company’s consistent monthly Bitcoin purchases—most recently adding 705 BTC on June 2—critics like Peter Schiff argue that continually raising the cost basis increases financial risk. He pointed out that with an average purchase price now exceeding $70,000, MicroStrategy could face enormous unrealized losses if Bitcoin dips sharply.

Potential Market Repercussions

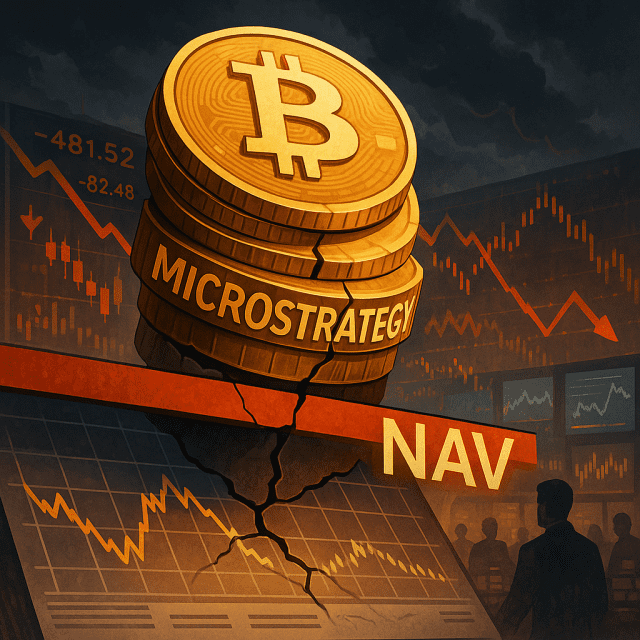

Crypto analyst Mippo suggested that MicroStrategy’s Bitcoin-heavy balance sheet, largely financed through convertible bonds, presents a “reflexive risk.” A sharp price drop could lead to a cascade of forced liquidations, echoing previous market collapses.

MicroStrategy itself acknowledged this in an SEC filing, noting that a significant decline in Bitcoin value could create liquidity and credit risks, potentially limiting access to new capital and pressuring the firm to sell BTC.

Saylor’s Response

Despite the warnings, MicroStrategy Executive Chairman Michael Saylor remains confident. Speaking at the Bitcoin 2025 Conference, he claimed the company has built an “anti-fragile” system capable of generating profits even if Bitcoin falls below its net asset value (NAV). He suggested that their structure allows them to benefit even if the stock trades at a discount to NAV, and that bearish pressure could create lucrative opportunities.

Saylor also rejected diversification into altcoins, arguing it would undermine MicroStrategy’s BTC-focused strategy and disrupt its bond issuance model.

Broader Adoption of Bitcoin by Public Companies

Despite concerns around MicroStrategy’s strategy, other firms are also embracing Bitcoin. Japanese firm Metaplanet saw its stock hit record highs after recent BTC purchases. GameStop also acquired 4,710 BTC, causing a rally in its stock price.

In addition, institutional interest in Ethereum and Solana is growing. Sharplink recently closed a $425 million Ethereum acquisition, and Pantera Capital forecasts continued demand for crypto exposure through stock-based products.

Conclusion

MicroStrategy’s massive $61 billion Bitcoin position—acquired at an average price of $70,000—comes with high stakes. If the price of Bitcoin drops below this threshold, the company may face pressure to sell, potentially impacting the broader crypto market. While Michael Saylor remains confident in the firm’s structure and strategy, market watchers remain alert to the risks such a scenario could trigger.