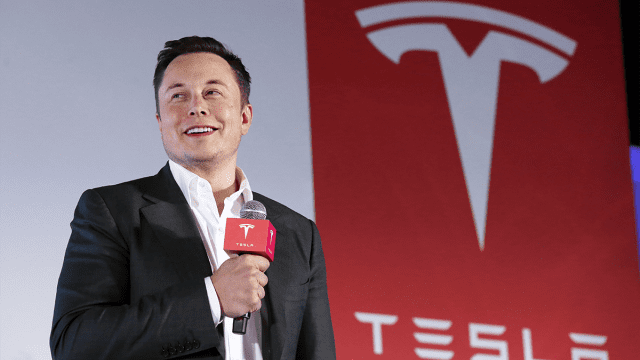

Tesla CEO Elon Musk claims the electric vehicle titan is already bouncing back. “Yes, we’ve had some sales losses… but the current numbers are solid,” Musk said during an appearance at the Qatar Economic Forum on Tuesday. Musk, who now wears multiple hats—including leading the Department of Government Efficiency (DOGE), advising U.S. President Donald Trump, and running several major companies—reassured markets of Tesla’s resilience.

Investors appeared to respond positively, with Tesla (NASDAQ: TSLA) stock rising 1% during Tuesday’s trading session.

Tesla’s share price has been volatile in recent months, as analysts debate whether Musk is helping or hurting the company. Earlier this year, stock prices surged on speculation that Trump’s administration might back EV initiatives, and more recently, optimism has resurfaced around Tesla’s Optimus humanoid robot, expected to debut in late 2025 or early 2026.

Still, excitement has waned amid Musk’s increasingly polarizing political presence. His vocal alignment with conservative politics has alienated some of Tesla’s traditionally liberal customer base, leading to softened sales and investor concerns that Musk may be prioritizing his influence in Washington over his responsibilities at Tesla.

Musk acknowledged Tesla’s struggles in Europe, noting a “very significant decline” in April sales. “It’s our weakest region,” he admitted, citing reasons ranging from tariffs to sluggish EV demand.

Nevertheless, Musk expressed confidence in a turnaround. “It’s already happening… the stock wouldn’t be trading this high if it weren’t,” he said, suggesting markets have already priced in a recovery.

When asked if he still plans to lead Tesla amid growing government obligations, Musk responded unequivocally: “Yes, absolutely,” pledging to stay on as CEO for at least five more years.

He also dismissed concerns about the $56 billion compensation package a Delaware judge struck down earlier this year. Taking aim at the decision, he quipped: “The activist pretending to be a judge in a Halloween outfit won’t change my commitment to Tesla.” What matters most, he added, is holding enough voting power to remain in control and prevent activist investors from ousting him.

Outside of Tesla, Musk’s other ventures are thriving. SpaceX now dominates the global space launch market and operates about 80% of all active satellites, thanks to its Starlink network.

While he hinted at a possible Starlink IPO, Musk voiced skepticism about public markets. “Starlink may go public eventually,” he said, but warned that shareholder lawsuits often undermine true investor interests.

Turning to OpenAI, the company he co-founded and is now suing, Musk accused the firm of betraying its original mission. “It’s like funding a nonprofit to protect the rainforest, and they turn around and commercialize the entire forest,” he said, referencing OpenAI’s transformation from an open-source nonprofit into a for-profit enterprise despite his early $50 million investment.

For now, Musk is adamant that Tesla is recovering, even as European sales lag and critics persist. Whether investors continue to buy into his turnaround story may hinge on how much attention he can still devote to running the company while navigating his growing political and business empire.