With its latest Bitcoin purchase, Strategy has achieved a 15.5% Bitcoin yield, surpassing its earlier 2025 benchmark—initially set at 15% and raised to 25% earlier this May.

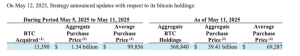

Led by co-founder Michael Saylor, Strategy made a significant Bitcoin acquisition as the cryptocurrency surged past the $100,000 mark last week. Between May 5 and May 11, the firm bought 13,390 BTC for a total of $1.34 billion, according to a filing with the U.S. Securities and Exchange Commission released on May 12.

This purchase increased Strategy’s total Bitcoin holdings by 2.4%, bringing its stash to 568,840 BTC. The cumulative cost of the holdings stands at around $39.4 billion, with an average purchase price of $69,287 per Bitcoin. The latest BTC acquisition was made at an average price of $99,856 per coin—just as Bitcoin broke past the $100,000 milestone on May 8.

Yield Target Surpassed

Following the announcement, Saylor confirmed in a post on X that the firm had reached its previous 2025 Bitcoin yield goal. The Bitcoin yield—measuring the percentage change in the ratio of BTC holdings to diluted share count—now stands at 15.5%.

Strategy originally aimed to sustain a 15% yield for the entirety of 2025, after achieving a 74% yield in 2024. The target was officially raised to 25% earlier this month.

Criticism From Skeptics

Despite reaching this benchmark, Strategy continues to face criticism for its aggressive Bitcoin buying strategy. Prominent Bitcoin skeptic Peter Schiff responded to the announcement with warnings about the potential downside of Strategy’s rising average BTC cost.

“If your next purchase lifts your average cost above $70,000, a price correction could push Bitcoin below that level, exposing your firm to significant losses,” Schiff posted on X, referring to the risk of turning paper losses into actual financial losses, especially given the leveraged nature of Strategy’s buys.

Schiff’s comments followed Strategy’s recent disclosure on May 1 that it plans to double its capital raise—targeting $42 billion each in equity and fixed-income offerings—to fund further Bitcoin acquisitions.

While Schiff has a long history of incorrect Bitcoin predictions, some in the crypto industry are also wary of Strategy’s bold accumulation approach. According to Bloomberg, crypto exchange Coinbase has evaluated and ultimately rejected similar Bitcoin accumulation strategies multiple times, concerned that it could conflict with its broader business model.