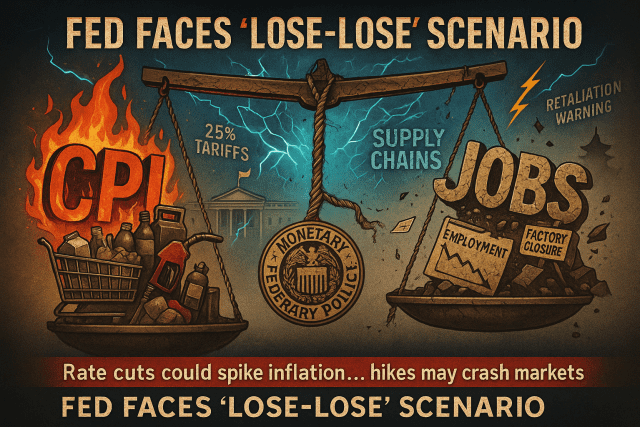

The Federal Reserve is preparing to navigate a challenging policy landscape as President Donald Trump’s new tariffs intensify the risks of both slower economic growth and rising inflation, setting up what Nick Timiraos of the Wall Street Journal describes as a “lose-lose” scenario.

The central bank now faces a tough balancing act: delay interest rate cuts and risk deeper economic weakness, or act too soon and potentially stoke inflation, the report explains.

A key concern is the threat of stagflation—marked by rising costs and disrupted supply chains—driven by trade-related pressures, Timiraos noted.

Fed officials are widely expected to keep rates unchanged at this week’s policy meeting, staying cautious while closely tracking the impact of tariffs on inflation and employment.

Some members advocate patience, pointing to ongoing inflation concerns and uncertainty around how tariffs might influence consumer spending and business investment. Others warn of an increasing risk of a more pronounced economic downturn, according to the WSJ.

The report highlights growing internal debate over whether price increases will be fleeting or more lasting, and whether the Fed should focus on preventing recession or bolstering its inflation-fighting credibility.

Fed policymakers remain mindful of past missteps, such as underestimating inflation during the pandemic rebound. For now, they seem prepared to endure short-term economic strain while waiting for clearer signals of a slowdown before easing rates, Timiraos reported.

If consumer and business expectations for stable prices hold up, the Fed may have more room to maneuver. But if confidence falters, officials could be forced to keep rates elevated even as growth weakens, the report concludes.