Solana Price Drops 47% Amid Investor Concerns and Market Weakness

Solana (SOL) has experienced a 47% decline since its January 19 high, dropping to approximately $157.25 by February 24. Investor sentiment has been shaken by concerns over its association with the Lazarus Group, an upcoming $1.79 billion token unlock, and declining futures market activity.

A head-and-shoulders pattern and a breakdown below the $177 support level suggest a possible drop to $110. However, if SOL holds above support, it could see a rebound toward $215.

Solana’s Price Performance

Following Donald Trump’s reelection, SOL has been struggling to maintain its gains. On February 24, the price dropped 7.35%, marking its lowest level since November 6. This decline extends a downtrend from January 19, when SOL reached an all-time high of $295.31 before tumbling nearly 47%.

Factors Driving SOL’s Decline

1️⃣ Lazarus Group Allegations – Reports linking Solana to North Korea-backed hacking group Lazarus have damaged investor confidence, as the network has been associated with memecoin scams and security breaches.

2️⃣ Upcoming Token Unlock – On March 1, 11.16 million SOL tokens worth $1.79 billion will be unlocked, mainly from the FTX estate. Investors fear that this influx of tokens into the market could increase selling pressure and push prices lower.

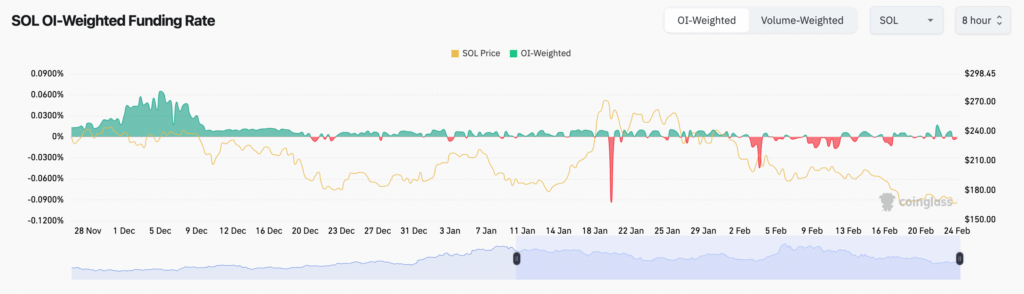

3️⃣ Weak Futures Market – Open interest in SOL futures has fallen from $8.57 billion on January 17 to $5.11 billion by February 24, signaling reduced speculative interest. Additionally, negative funding rates suggest that long-position holders are paying short sellers, reflecting bearish sentiment.

Technical Analysis: Bearish Pattern Suggests Further Downside

🔻 Bearish Head-and-Shoulders Formation – SOL’s price chart exhibits a head-and-shoulders pattern, a bearish technical signal. The breakdown below $177 support indicates a possible drop to $110, which would represent another 30% decline from current levels.

🔹 Potential Rebound to $215 – If SOL holds above its support level, there is a chance of recovery toward $215. However, diminishing interest in Solana-based memecoins like Official Trump, Bonk, and Dogwifhat has also reduced network activity, weakening demand for SOL, which is required for transaction fees.

Market Outlook

Solana faces a combination of bearish factors, including hacks, upcoming token unlocks, weak futures activity, and negative technical signals. Traders are remaining cautious, waiting for clearer market direction—whether a further decline or a potential recovery.