U.S. States Invest in Strategy Stock for Indirect Bitcoin Exposure

Several U.S. states, including California, Florida, Wisconsin, and North Carolina, have been investing in Strategy stock (formerly MicroStrategy) as a means to gain indirect exposure to Bitcoin. This move allows state pension funds and treasuries to benefit from Bitcoin’s potential without directly holding the cryptocurrency.

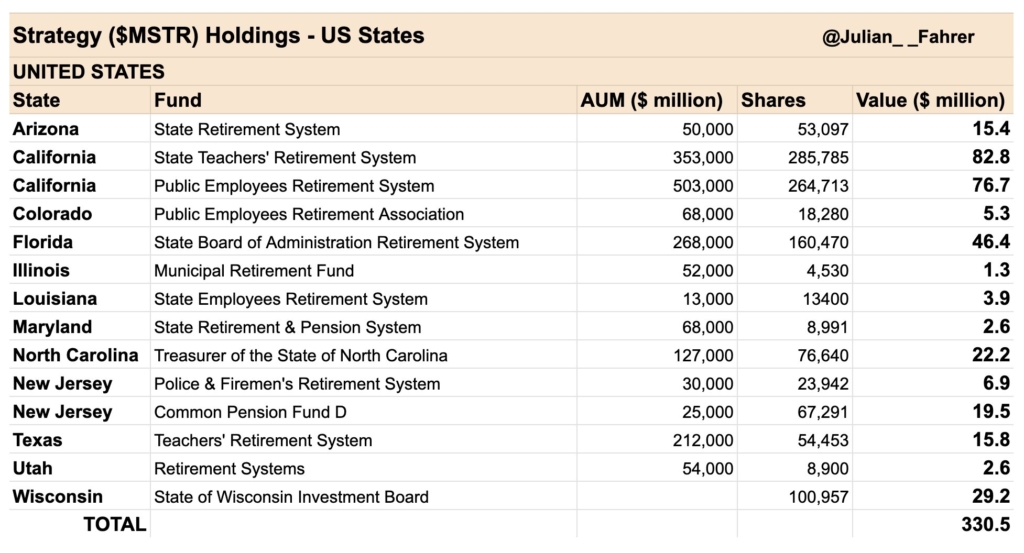

State Investments in Strategy Stock

Leading the charge, California’s State Teachers Retirement System holds 285,785 shares valued at approximately $83 million, while CalPERS owns 264,713 shares worth around $76 million. By the end of 2024, a total of 12 U.S. states had collectively invested over $330 million in Strategy stock.

This trend extends beyond the U.S., with international investors such as Canada’s Healthcare of Ontario Pension Plan and South Korea’s National Pension Service also taking substantial stakes in Strategy. The company’s appeal stems from its massive Bitcoin holdings—478,740 BTC, valued at an estimated $46 billion—which have contributed to a 383% surge in its stock price over the past year, significantly outperforming the broader crypto market.

Legislative Support and Future Growth

In addition to these investments, legislative proposals such as West Virginia’s Inflation Protection Act highlight a growing interest in incorporating digital assets into public investment portfolios. These initiatives suggest a shifting regulatory environment that could further encourage states to explore Bitcoin-related investment strategies.

Despite facing a $670.8 million loss in Q4 2024 due to a Bitcoin impairment charge, Strategy remains committed to its long-term “21/21 Plan”, which aims to raise $42 billion to expand its Bitcoin portfolio. This ongoing commitment reinforces positive sentiment around digital asset adoption within public investment funds.

A Strategic Approach to Bitcoin Exposure

As U.S. states continue to diversify their portfolios, Strategy stock presents a compelling alternative for gaining exposure to Bitcoin without directly managing the risks associated with cryptocurrency markets. With increasing state and institutional interest, indirect Bitcoin investment through public companies could become a growing trend in government-managed funds.