Bitcoin Drops Below $94K as Trump’s Tariffs Trigger Massive Sell-Off

Key Takeaways:

- Bitcoin (BTC) fell below $94,000, hitting an intraday low of $91,242 as market panic set in.

- Ethereum (ETH) plunged over 26% to $2,159, while memecoins and altcoins also suffered heavy losses.

- Trump’s 25% tariff on Mexican and Canadian imports and 10% levy on Chinese goods fueled fears of an escalating trade war.

- The crypto market lost nearly $2 billion, with $2.27 billion in liquidations, including $1.89 billion in long positions within 12 hours.

- Analysts predict continued volatility as global economic uncertainty rises.

Crypto Market Reacts to Trump’s Tariff Decision

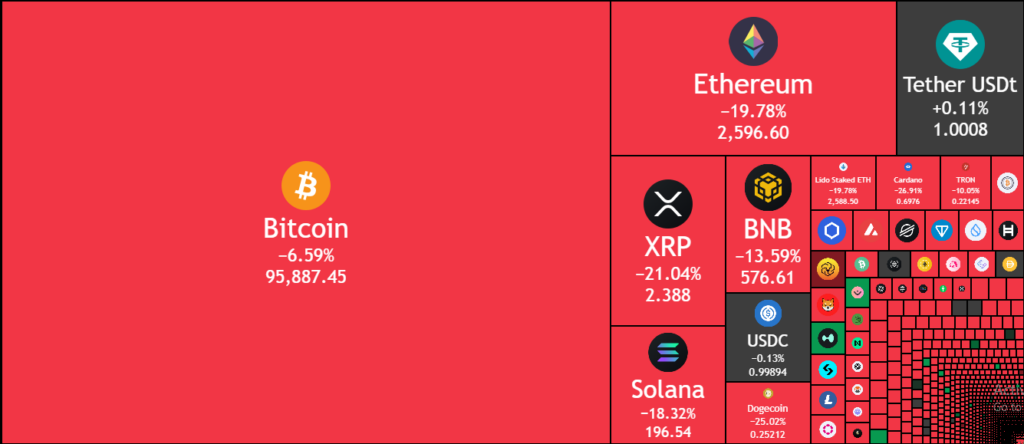

The cryptocurrency sector faced a significant downturn following U.S. President Donald Trump’s latest tariff measures. Bitcoin (BTC) dropped below $94,000, touching a low of $91,242, while Ethereum (ETH) saw a steep 26% decline, sinking to $2,159. Investors reacted sharply to the news, causing widespread sell-offs.

Trump’s new tariffs—a 25% tax on imports from Mexico and Canada, along with a 10% levy on Chinese goods—have raised concerns about an impending trade war. Affected nations, including Canada, responded with retaliatory tariffs on $155 billion worth of U.S. goods. The move has heightened fears of global economic instability.

Billions Liquidated as Market Panic Sets In

Bitcoin’s sharp decline erased approximately $2.27 billion from the crypto market, including $1.89 billion in liquidated long positions over a 12-hour period, according to Coinglass. In the last 24 hours, 745,971 traders were liquidated, reflecting a massive shift in sentiment.

Ethereum suffered its worst intraday drop since 2021, falling to $2,135, while DOGE (-23%), XRP (-21.6%), and Solana (-8%) also tumbled. The overall crypto market capitalization shed nearly $2 billion, highlighting the impact of tariff-driven economic policies.

Despite the downturn, Robert Kiyosaki, renowned investor and author, remained optimistic:

“Gold, silver, and Bitcoin may crash—good. Crashes mean assets are on sale. Time to get richer.”

Analysts Predict Further Market Volatility

The trade war concerns extend beyond crypto, affecting global stock markets. The U.S. dollar surged, while equities and risk assets plummeted. U.S. stock futures dropped 2%, and European markets saw a 2.8% decline.

With tensions rising, Jorge Montepeque, Director of Benchmark, criticized Trump’s tariffs, calling them “economically dumb” in a recent podcast. The European Union has also hinted at countermeasures if similar tariffs are imposed on its member states.

What’s Next for Bitcoin and the Crypto Market?

Despite the turmoil, Bitcoin remains the dominant force in the crypto space, holding over 60% market share. Analysts suggest that while short-term volatility is expected, Bitcoin may rebound strongly as market conditions stabilize.

With the Federal Reserve maintaining a cautious stance and global trade tensions escalating, the next developments in the ongoing trade war will likely shape the crypto market’s trajectory in the coming months.