Ethereum Price Drops 9%, Leading $700 Million in Liquidations

Ethereum’s price plunged by 9% during the largest crypto market crash this month, contributing to $700 million in liquidations.

Key Highlights:

- Ethereum led crypto liquidations, with over $152 million in ETH positions wiped out.

- Institutional investors and whales offloaded ETH holdings, further driving the price decline.

- Spot Ethereum ETFs recorded net outflows, signaling weakened market confidence.

Ethereum Price Plummets Amid Market Selloff

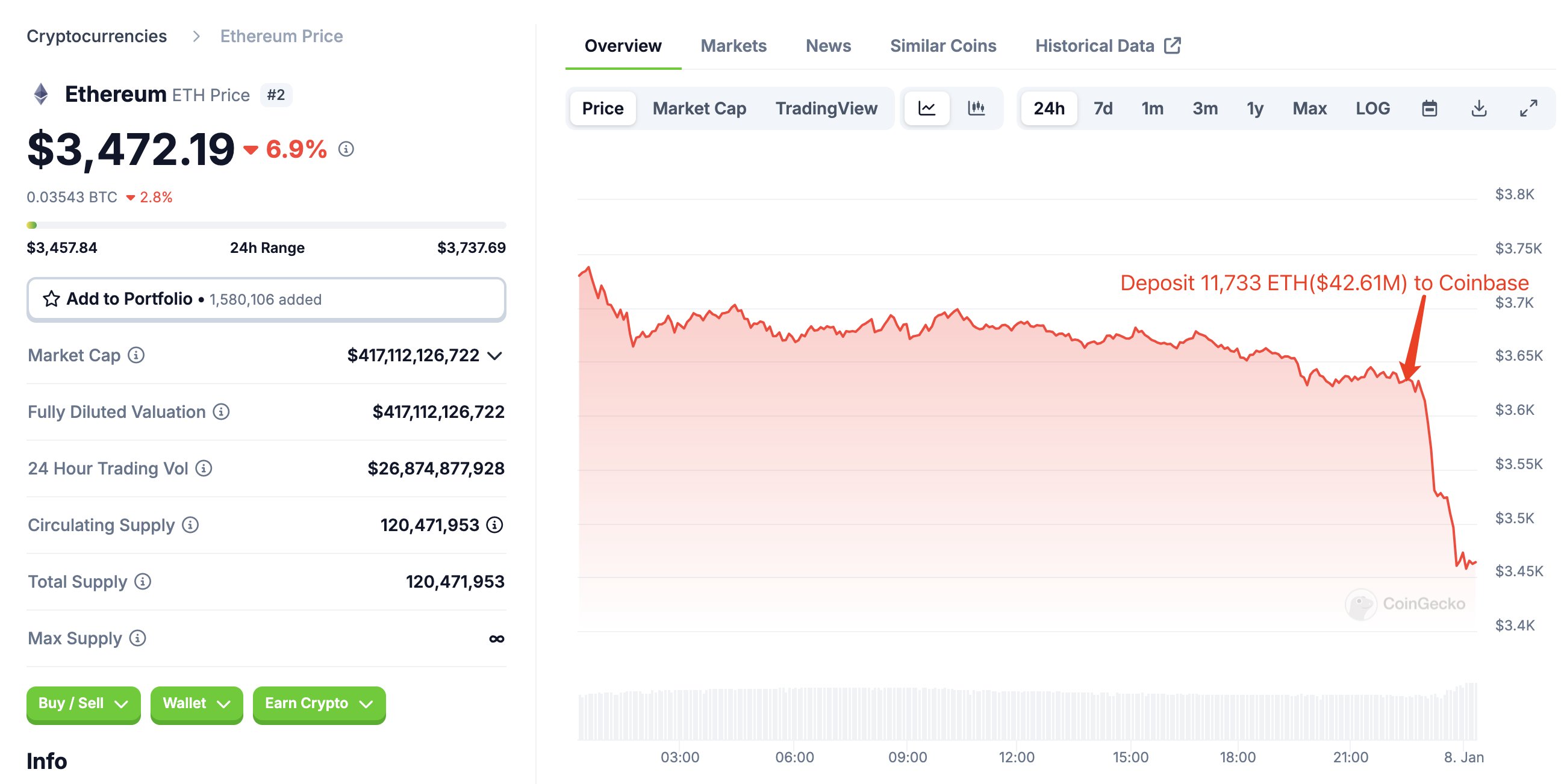

In the past 24 hours, Ethereum’s price fell to $3,300, erasing gains made since mid-November. The selloff was triggered by robust U.S. macroeconomic data, which diminished hopes for Federal Reserve rate cuts. According to Coinglass, $152 million worth of ETH was liquidated, with $132 million in long positions. This accounted for a significant portion of the $710 million total crypto liquidation.

Major ETH Liquidations

Over 237,000 traders were liquidated during the crash, with the largest single ETH liquidation occurring on Binance—valued at $17.74 million. This is among the largest ETH liquidations recorded.

Institutional and Whale Selloff

Large ETH transfers have been reported, including:

- 40,000 ETH (worth $140.44 million) moved from Arbitrum to Binance.

- 18,172 ETH ($66 million) transferred from Cumberland to Coinbase Institutional.

- WisdomTree deposited 11,733 ETH into Coinbase shortly before the crash.

These movements indicate significant offloading by whales and institutional investors as sentiment weakened due to strong U.S. economic data, specifically JOLTS job openings and ISM Services PMI reports.

Ethereum Foundation’s 2025 ETH Sale

The Ethereum Foundation completed its first ETH sale of 2025, converting 100 ETH ($336,000) into 329,463 DAI. This follows $12.96 million worth of ETH sales in 2024, which limited Ethereum’s price upside.

Spot Ethereum ETFs Show Outflows

Spot Ethereum ETFs witnessed $86.8 million in net outflows, mainly from major funds like Fidelity’s FETH, Grayscale’s ETHE, and smaller ETFs. These outflows reflect investor sentiment, often viewed as a key indicator of asset strength.

Outlook for Ethereum’s Price

Ethereum is currently trading at $3,329, with no immediate signs of recovery. Analysts have set ambitious price targets of $5,000 to $10,000 for 2025, though the market remains uncertain.

Derivative data shows a 7% drop in open interest for ETH futures, now valued at $30.33 billion, while options open interest increased as traders adjusted positions.

Analyst Predictions:

- IncomeSharks: Suggests a quick scalp trade after a potential price bounce before closing longs.

- Crypto Tony: Remains bullish as long as ETH holds above $3,200 in daily closes.

Market observers are closely watching ETH price movements for signs of stabilization or further volatility.