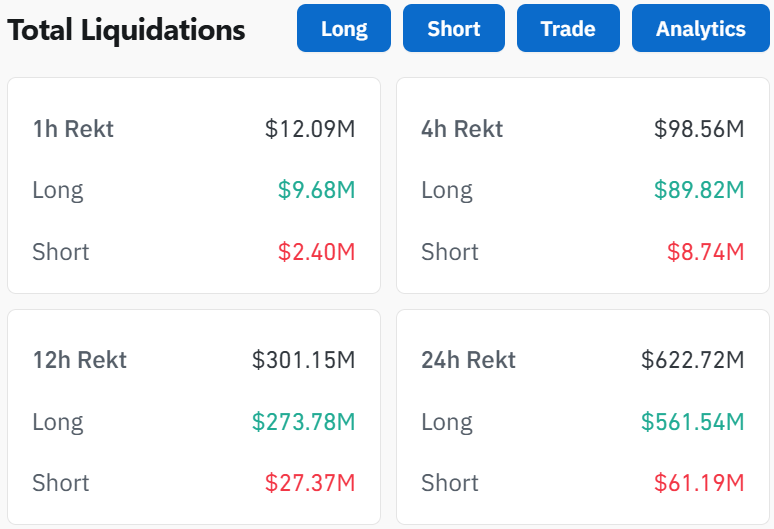

The global cryptocurrency market cap has fallen by 6.41%, declining from $3.59 trillion to $3.36 trillion, signaling widespread losses. In the past 24 hours, crypto liquidations have totaled over $622 million.

Market Decline Amid Economic Pressures

During Asian trading hours, the market experienced a significant correction, with major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and several altcoins suffering notable losses. This pullback was influenced by a broader sell-off in U.S. tech stocks, including Nvidia and Tesla, amid rising macroeconomic concerns.

Bitcoin Dips Below $100K

Bitcoin dropped by 5.79% to $96,120, breaking below the critical $100,000 support level. Ethereum fell nearly 9% to $3,343 after retreating from its $3.5K target. Meanwhile, Ripple’s XRP slid 7.72% to $2.27. Meme coins were not spared either, with Dogecoin losing 12.77% to trade at $0.3464.

Liquidation Spike

In the last 24 hours, $622.26 million in crypto positions were liquidated across nearly 202,099 traders. The largest single liquidation occurred on Binance, involving an ETH/USDT position worth $17.74 million.

Reasons Behind the Crypto Market Crash

The sharp correction in the crypto market is tied to concerns about the U.S. economy, which have impacted both traditional and digital assets. Key contributing factors include:

- Rising Treasury Yields: The 10-year yield increased to 4.7%, signaling tighter monetary policies that discouraged investments in riskier assets like cryptocurrencies.

- Weak Tech Sector Performance: Higher bond yields and expectations of further Federal Reserve action to control inflation weighed heavily on tech stocks, creating a domino effect in the crypto market.

- Labor Market Data: A surge in job vacancies has heightened inflation fears, prompting expectations of a more aggressive stance from the Federal Reserve.

The combination of rising yields and inflation concerns has led to investor caution, pulling back from riskier markets.

What’s Next for Investors?

- Buying Opportunity: Long-term investors may view the market dip as a chance to accumulate assets at lower prices. Historically, Bitcoin has recovered strongly after major corrections.

- Hold Strategy: Risk-averse investors may prefer holding their positions to avoid losses during market volatility.

- Market Risks: Rising bond yields and macroeconomic pressures could continue to exert downward pressure on cryptocurrencies, especially with a strengthening U.S. dollar.

Despite the downturn, analysts remain optimistic about the overall market trajectory. Bitcoin’s long-term bull market appears intact, and growing institutional interest and adoption could drive recovery once economic conditions stabilize.