Bitcoin News: Report Suggests BTC Could Drop $20K Amid Volatility

Highlights:

- A new report predicts Bitcoin may experience a $20K crash in the coming weeks.

- The analysis links Bitcoin’s price trends to changes in global money supply, signaling a potential correction.

- Despite bearish predictions, some indicators suggest Bitcoin’s recovery remains possible.

Bitcoin’s Potential $20K Crash

A recent report from The Kobeissi Letter warns of a potential $20,000 drop in Bitcoin’s price within the next few weeks. The analysis highlights Bitcoin’s historical correlation with global money supply trends, suggesting that if the pattern continues, a sharp correction could be imminent.

Global money supply peaked at $108.5 trillion in October, coinciding with Bitcoin’s all-time high of $108,000. However, a subsequent $4.1 trillion decline in money supply to $104.4 trillion has raised concerns about Bitcoin’s near-term performance. The Kobeissi Letter notes that this relationship, which operates on a 10-week lag, indicates a potential $20K drop for BTC, especially as market volatility intensifies and Bitcoin recently fell below the $100K mark.

Market Sentiment and BTC’s Path Forward

Despite this bearish outlook, Bitcoin has shown resilience in 2024, driven by positive news and a strong rally earlier this year. Traders are closely monitoring macroeconomic indicators, including monetary supply shifts, to assess the likelihood of Bitcoin defying this predicted trend.

If the forecasted correction occurs, it could be a pivotal moment for Bitcoin, testing its status as a safe haven during economic uncertainty. Financial author Robert Kiyosaki recently pointed to a possible economic depression, advising investors to turn to Bitcoin as a hedge.

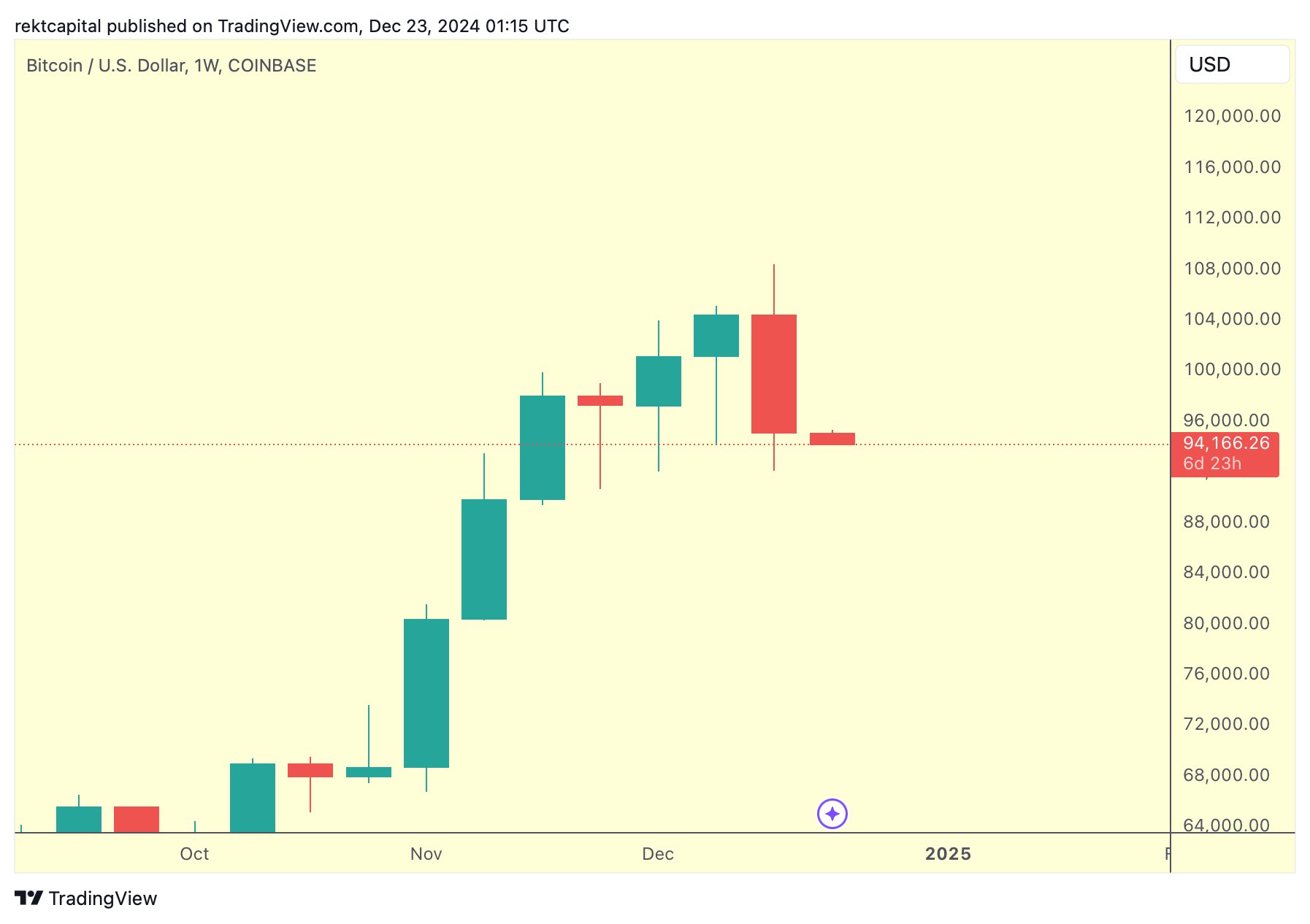

However, bearish indicators continue to dominate market sentiment. Crypto analyst Rekt Capital noted that Bitcoin has confirmed a bearish engulfing candlestick formation, losing weekly support and ending a five-week uptrend. This signals the potential for a multi-week correction ahead.

Institutional Interest and Price Trends

Despite the bearish momentum, institutional interest in Bitcoin remains robust. Companies like Matador plan to purchase $4.5 million worth of BTC, while MicroStrategy continues to accumulate Bitcoin, reflecting confidence in its long-term potential.

As of now, Bitcoin’s price is down 1% to $94,430, with a trading volume of $54.39 billion in the past 24 hours. Bitcoin touched a high of $97,217 during the same period. Analysts have identified three potential factors that could help reverse the bearish trend, offering hope for a recovery.

Bitcoin’s performance in the coming weeks will be closely watched as market participants weigh its potential for recovery against bearish forecasts.