Crypto and Stock Markets Plunge as Putin Signs Nuclear Decree Amid Tensions

Key Highlights:

- Bitcoin, Ethereum, Solana, and XRP experience sudden declines.

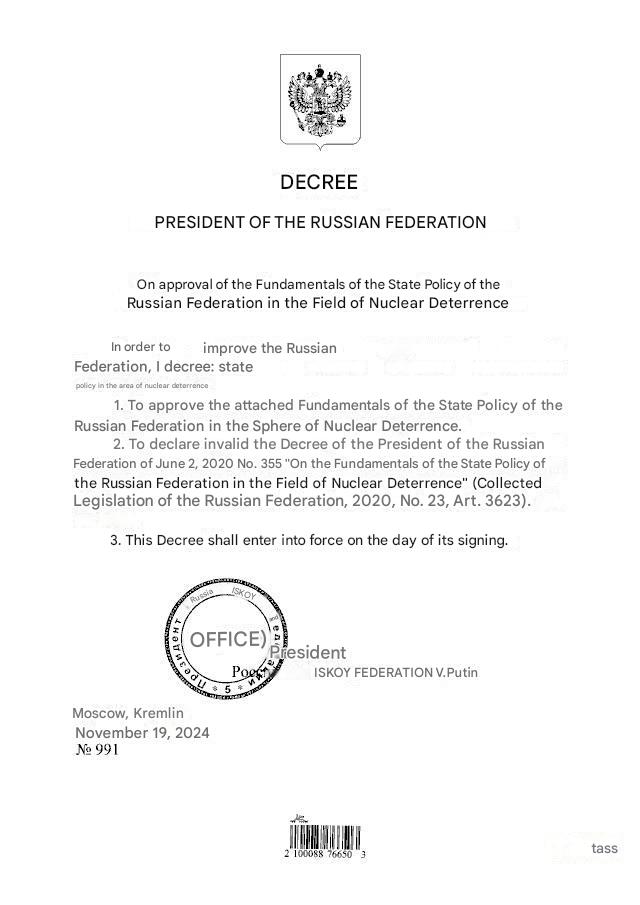

- Russian President Vladimir Putin signs a decree permitting the use of nuclear weapons against non-nuclear states.

- Global stocks and crypto markets reverse recent gains amid heightened geopolitical concerns.

The cryptocurrency market, including Bitcoin, Ethereum, Solana, and XRP, experienced sharp declines on Tuesday following Russian President Vladimir Putin’s decree authorizing the use of nuclear weapons against non-nuclear states supported by nuclear powers. Stock markets worldwide also faced steep losses as tensions escalated. This decision comes after U.S. President Joe Biden authorized Ukraine to strike Russian territories using U.S.-supplied missiles.

Putin’s Nuclear Decree Sends Shockwaves Through Markets

On November 19, President Putin approved a decree allowing Russia to use nuclear weapons against non-nuclear states in military blocs supported by nuclear powers. Reports indicate that Russia will consider any attack by a nation within a military bloc as an assault by the entire bloc.

The decree triggered global market instability, with stock markets experiencing panic-driven selloffs, reversing earlier gains. This geopolitical development has undermined peace efforts previously pursued by former U.S. President Donald Trump.

Crypto Market Reacts with a Sharp Selloff

According to Coinglass data, the crypto market witnessed significant selloffs, with Bitcoin (BTC) and Ethereum (ETH) dropping nearly 0.50% each. Altcoins like XRP, Dogecoin (DOGE), and Cardano (ADA) saw losses exceeding 1% within an hour. Notable gainers from recent sessions, including PNUT, RAY, XTZ, and AKT, emerged as major losers, with PNUT losing 5% to trade at $1.68.

Market Outlook: Will BTC Plummet Further?

U.S. stock futures tied to major indices such as the S&P 500, Dow Jones, and Nasdaq Composite also suffered declines. Pre-market trading saw Coinbase stock drop 3% to $315.50, while MicroStrategy shares fell 1.31% to $379.76.

Analysts have warned of a possible 10% correction for Bitcoin, with key support levels at $85,800-$83,250 and $75,520-$72,880. Extreme greed in the market, as indicated by the Crypto Fear and Greed Index, suggests the potential for profit booking.

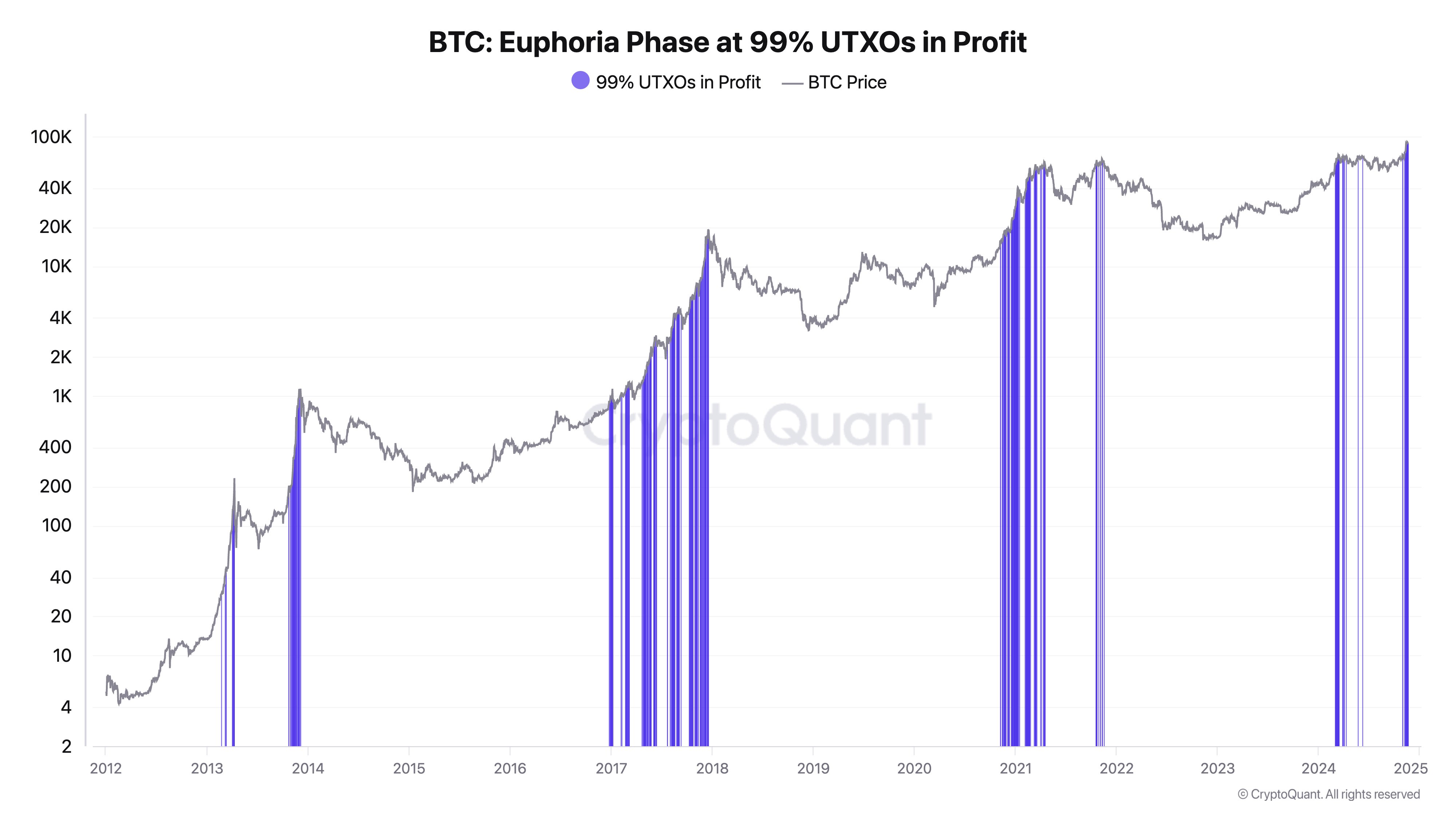

CryptoQuant CEO Ki Young Ju noted that 99.3% of Bitcoin UTXOs are currently in profit, signaling a euphoric phase that historically lasts 3–12 months, barring exceptions like the November 2021 bull trap.

Bitcoin’s current price stands at $91,274, down 0.86% in the last 24 hours, with a 24-hour range of $89,393 to $92,596.