ChatGPT suggests a potential timeline for Bitcoin reaching $100,000, highlighting market trends that could fuel a BTC rally amid volatility surrounding the U.S. election.

Highlights:

- ChatGPT projects when Bitcoin might hit $100K, noting key factors that could drive its long-anticipated rally.

- The U.S. election and the upcoming FOMC decision are also seen as possible catalysts for a crypto price surge.

- A recent forecast indicates a potential rally pushing BTC to $84K in November.

As investor anticipation builds, ChatGPT has emerged as a tool for predicting Bitcoin’s price trajectory. Leveraging real-time data and AI capabilities, ChatGPT is now being used to project Bitcoin’s journey to $100,000, along with the factors that may assist it along the way.

ChatGPT’s Timeline for Bitcoin’s Rise to $100K

When asked about the timeframe for Bitcoin to reach $100K, ChatGPT outlines three scenarios. In an optimistic case, Bitcoin could hit $100,000 by late 2024 or early 2025, driven by halving impacts, ETF inflows, and favorable economic conditions. A moderate projection places this milestone in 2025 or 2026, while a conservative view, considering economic or regulatory hurdles, extends this to 2026 or beyond.

Factors Supporting the Rally

ChatGPT identifies critical factors as potential catalysts for Bitcoin’s price ascent to $100K, including market cycles, institutional investment, and economic trends. The recent Bitcoin halving could create a supply squeeze, potentially boosting BTC’s price within 12–18 months, possibly hitting $100,000 by late 2024 or early 2025.

Institutional adoption also fuels BTC’s growth prospects. With U.S. Spot Bitcoin ETFs opening doors to institutional capital, Bitcoin gains legitimacy and may experience accelerated growth. Additionally, economic conditions such as inflation and monetary policy shifts could further influence demand for BTC, often viewed as a hedge against inflation and fiat instability.

ChatGPT suggests that if central banks, particularly the Federal Reserve, adopt dovish policies amid economic slowdowns, demand for Bitcoin could increase. Notably, the U.S. FOMC is expected to announce a rate cut of 25 basis points, potentially sparking a broader crypto rally.

What’s Next for BTC?

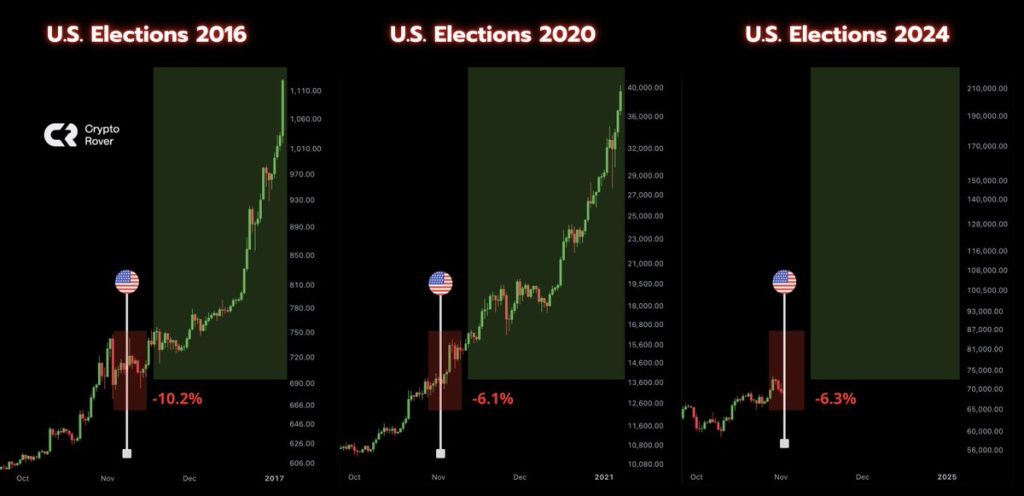

Bitcoin is currently trading around $68,747, with a 24% surge in trading volume to $41.54 billion. The market anticipates increased volatility ahead of the U.S. election. Historically, Bitcoin has rebounded after elections, which many hope will drive a renewed rally.

Market expert Crypto Rover recently highlighted BTC’s typical volatility during elections, followed by strong post-election performance, boosting investor optimism. Additionally, CoinGlass data shows Bitcoin Futures Open Interest (OI) rose by over 1% to $40.02 billion, with expectations for significant market swings during the election.

Will the Bitcoin Rally Persist?

Beyond these factors, ChatGPT notes other elements that could push BTC’s price higher. With a capped supply of 21 million coins and over 19 million already mined, Bitcoin’s scarcity adds upward pressure as demand rises. Growing adoption for cross-border payments in emerging markets also strengthens Bitcoin’s position as a store of value, especially in regions facing currency devaluation.

The U.S. election could further fuel BTC’s upward momentum, with the FOMC and other macroeconomic events also likely to support a rally in the coming days.