Veteran trader Peter Brandt predicts a drop in Bitcoin’s price to $46,000 as BTC slips below $56K. Here, we examine the potential causes of today’s decline.

Key Points:

- Bitcoin’s price fell below the $56,000 mark, raising concerns in the market.

- Peter Brandt forecasts a dip to $46,000, citing a bearish market pattern.

- Investors are now watching for US job data amid rising uncertainties.

Recently, Bitcoin’s price dipped below $56,000, catching the attention of investors. Veteran trader Peter Brandt has shared a bearish forecast, predicting Bitcoin could fall further to $46,000.

Let’s explore the factors potentially driving this slump in Bitcoin’s performance.

Peter Brandt Predicts BTC Price Drop to $46K:

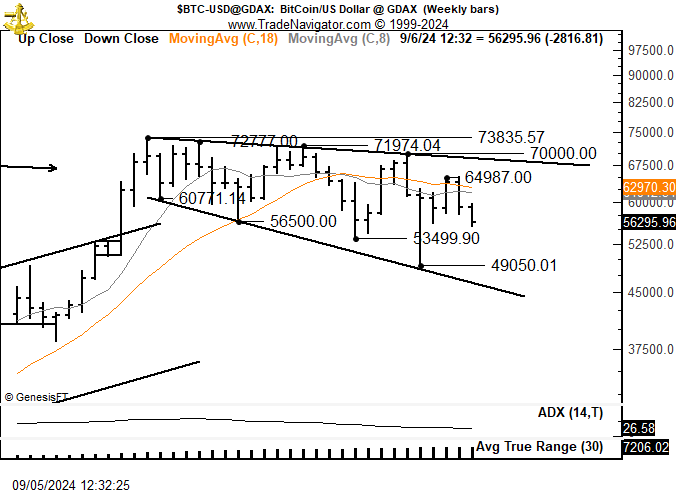

Brandt highlighted a concerning pattern, called an “inverted expanding triangle” or “megaphone,” which could push Bitcoin’s price down to $46,000 if the lower boundary is tested. This bearish formation reflects strong selling pressure, making a rally crucial to reinvigorate the bull market. Brandt noted that Bitcoin’s pattern of lower highs and lows indicates weakening buying momentum, which is unusual after a halving event.

This declining enthusiasm among investors is further weighing down market sentiment and prolonging Bitcoin’s price slide.

What’s Behind the BTC Price Drop Today? Awaiting US Job Data:

The market is focused on the upcoming US non-farm payroll data, which will be released by the Labor Department. This data is expected to influence market sentiment ahead of the Federal Reserve’s September meeting, with investors pausing in anticipation of a potential interest rate cut.

Whale Activity:

Some large investors, or “whales,” are exiting the Bitcoin market to secure profits amid heightened volatility. One whale recently offloaded 680 BTC, worth $38.77 million, after accumulating over 4,500 BTC since December 2022.

Bitcoin ETF Outflows:

The US Spot Bitcoin ETF has also seen poor performance recently, with outflows reaching $325 million over six trading days. This waning momentum has raised concerns among investors, adding further pressure on BTC’s price.